UK Companies Set For A Rampant 12 Months Of M&A Activity

Posted on May 9, 2017 By

Benchmark International

According to a recent report, UK companies are braced for a surge in deal-making this year, as executives prepare their businesses for life away from the European Union.

Accountancy juggernaut Ernst & Young found that 51% of UK firms expect to actively pursue mergers and acquisitions within the next 12 months, a rise of three percent from October 2016, but slightly lagging behind the global figure of 56%.

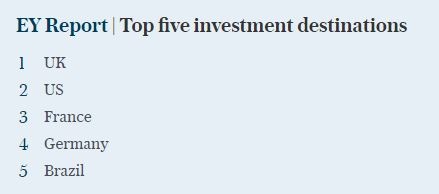

Despite the backdrop of a looming general election and Brexit negotiations, the UK has reclaimed its spot as the third most attractive destination for deal-making, having dropped out of the top five for the first time in the report’s seven-year history last October in the wake of the EU referendum.

Such a rejuvenated appetite for UK deals comes after Theresa May triggered Article 50 in March.

EY found 23% of global companies said that clarity over the Brexit negotiations timetable since then has increased their chances of investing in the UK. Author of the report, Steve Ivermee, said: “That the UK remains a top destination for domestic and global companies to do deals is a measure of its continuing attractiveness.”

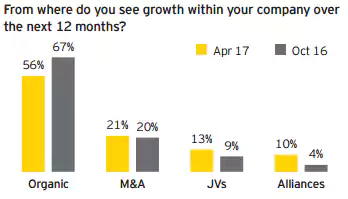

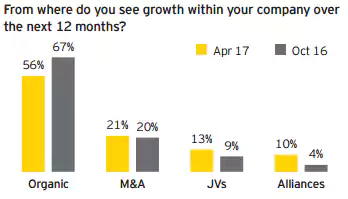

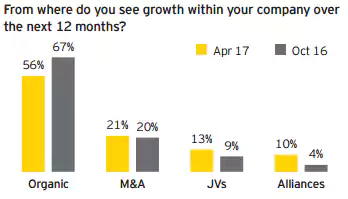

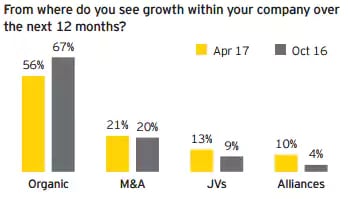

However, he warned: “The UK will need to work hard to maintain its position as the Brexit negotiations unfold.” As British companies move to maximise growth opportunities ahead of the country’s separation from the EU, there has been an 11% fall in the number of businesses expecting growth to come from organic sources.

Focus has instead shifted towards inorganic growth, such as joint ventures, in the wake of last year’s Brexit vote.

Almost a quarter of respondents expect growth to come from joint ventures, compared with just 13% six months ago, EY said, after surveying more than 2,300 executives in 43 countries last month.

Stay tuned to our blog for industry M&A analysis and remember to get in touch with our experienced team with any questions you have about the M&A process and how Benchmark International can help you.