A host of internal and external factors need to be considered when selling a company in order to ensure that maximum value is received upon its eventual sale.

External factors effecting company sales

External market factors play a huge role in determining levels of demand and the amount acquirers are willing to pay. Industry trends, economic conditions, the country’s legislative and tax environment and interest rates are all constantly changing external factors which can play a huge role in determining value.

External factors effecting company sales

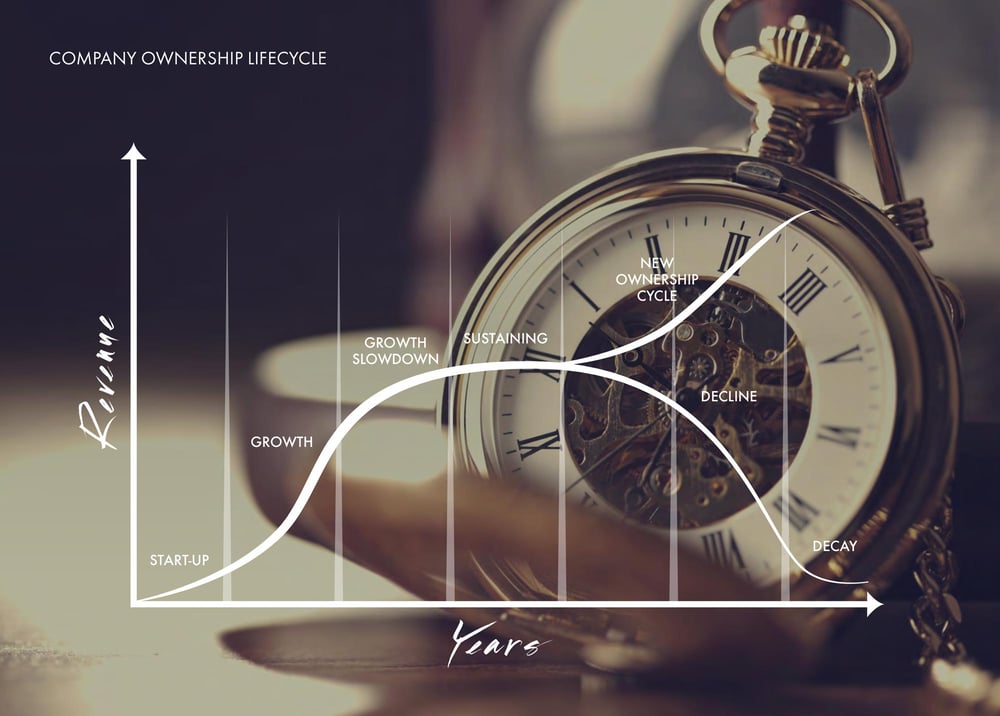

Internal factors, obviously will largely determine the companies value. Profit levels, turnover and consistency of the companies financial performance, location, assets and IPR are just some of the internal factors which will determine a company’s value. Additionally, the companies position on the business life cycle tends to greatly affect demand for companies. Acquirers generally find growing companies the most attractive as it increases confidence over future earnings potential.

As is the case with external market conditions, internal factors constantly change and evolve meaning that company value tends to fluctuate regularly. With this in mind it becomes fairly obvious that timing an exit correctly is crucial to receiving the highest value.

Putting off an exit plan

It is imperative that company owners always consider their eventual exit. Too many owners postpone planning their exit as they take cannot yet foresee a time when they would want to sell. This procrastination can all to often lead to significantly reduced transaction value or even worse, their company can become unsalable as it may have fallen too far into decline for an acquirer to take a risk on it.

The diagram below visualises the ownership lifecycle of a business perfectly. All companies tend to reach a point where growth naturally reduces and peaks. At this point, external investment or alternative ownership is the only way to ensure the company experiences a second wind.

The acquisitions market

The current acquisitions market is extremely active, particularly in the lower mid-market where corporate and private equity acquirers are turning their attention as larger acquisitions prove to be extremely risky. Interest rates are at an all time low meaning access to capital is driving demand for company acquisitions. In the private equity sector years of low levels of activity means that pressure to invest is forcing firms into acquisitions. Increasing demand is leading to high levels of competitive tension and rising deal values.

Benchmark International

Benchmark International  Benchmark International

Benchmark International