It is quite common in privately-held businesses for one or more of the owners of the client company to also own the real estate that the company occupies. That real estate may be in the name of the owner individually, or in name of another company (LLC, partnership, or corporation). In nearly every instance where the owner of the real estate is not an individual, such owner will be a pass-through entity (i.e., a subchapter S corporation, a partnership, or a trust). The company will lease the real property from the related party and recognize rent expense on the income statement. There may or may not be a formal, documented lease. Generally, these leases are triple net, meaning the tenant company pays all the maintenance costs, the insurance, and the taxes for the property.

There are several advantages for owners to hold their real estate outside of their operating business.

- It provides an avenue for additional income to flow to the owner without the necessity of paying payroll taxes.

- If the owners have other real estate holdings, they can use excessive rents to generate passive income to offset passive losses from other holdings.

- It allows the owners to separate the operating activities of their business from the real estate holdings in the event of a sale.

For business valuation purposes, we need to consider the effect of these related party leases that were not negotiated at arm's length. The lease rate may be more or less than the market. If the business is struggling, the lease may be below market. If the business is performing well, the rent will be above the market. For calculating an adjusted EBITDA, we should calculate an adjustment based on the difference between market rates and the related party lease rate. If the lease rate is below market, we have a deduction from book EBITDA. Conversely, if the lease is above market, we have an addition to book EBITDA.

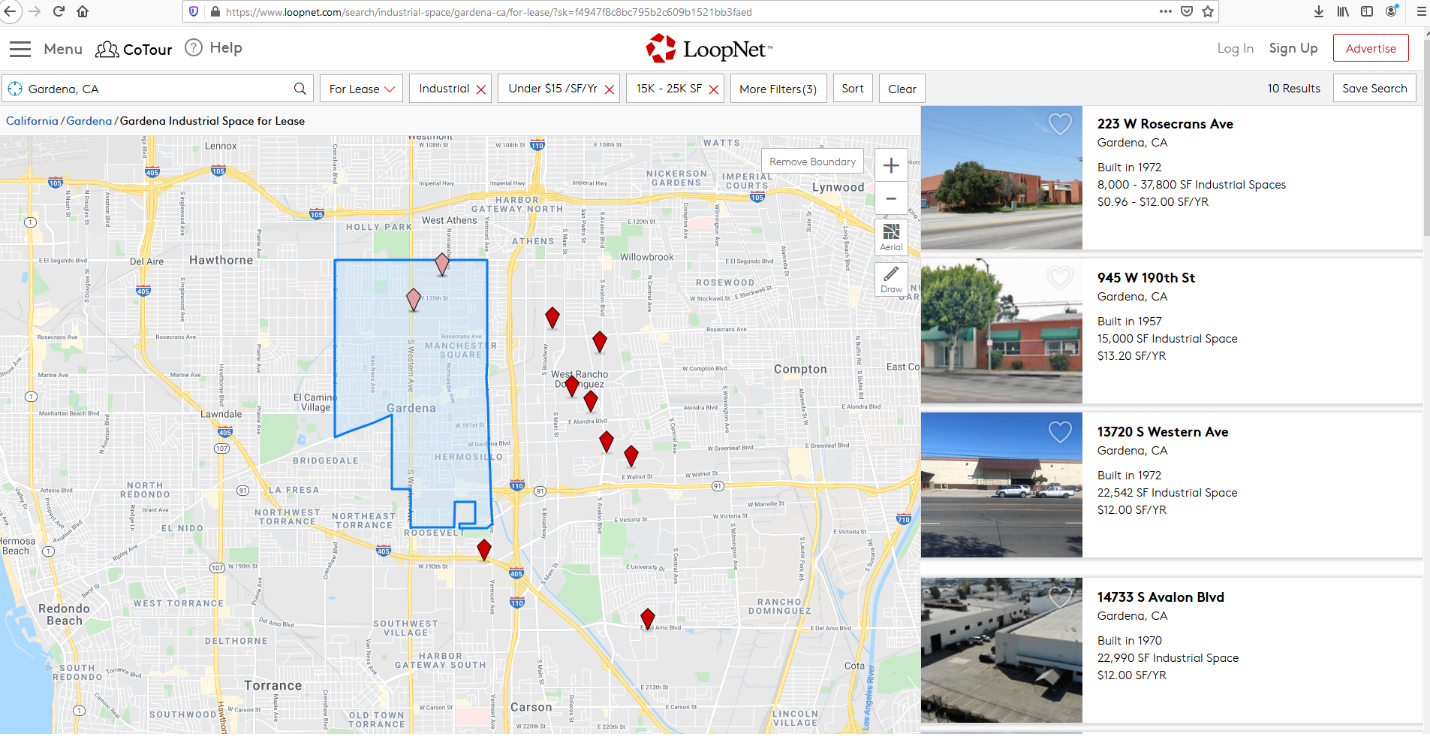

In calculating the adjustment, it is necessary to make a determination of what the market rent would be. In doing so, we must look at comparable properties in the area around the client’s property and find what the going lease rates are. LoopNet.com provides a relatively good comparison of properties that are on the market with asking prices. It is important to understand the characteristics of the building that the client is occupying and if there are any special use considerations. For example, a prospective client operates a precision CNC machine shop in Southern California in a 22,000 square foot building in an industrial area with a zoning of light industrial. They have about 16,900 square feet of outside space for parking and storage. Since they are operating CNC and heat-treating equipment, they need at least 1,000 amps of 3 phase power coming into the building. A comparable building, then, has these characteristics. Comparing this property to Class A office space is not a good comparison.

Note: Some special purpose buildings can have characteristics that are hard to match in the market. In that case, we must estimate the additional costs associated with what makes the building unique.

Pictured is a Loopnet.com example of a property search in Gardena, CA for industrial properties to lease in the 15,000 to 25,000 square foot range under $15 per foot. It indicates that there are several parcels that are comparable.

To continue the example, the prospective client company leases the real estate from a separate entity owned 100% by the sole shareholder for $60,650 per month. The asking price for comparable properties in the area is approximately $12.50 per foot. As such, the market rent for a 22,000 square foot facility would be $275,000 per year. In looking further at just land, the lease rate is about $7.20 per foot or another $123,708 per year. The total annual market rent for this site would be $398,708 compared to the actual lease rate of $602,461. In this case, we have a positive adjustment to book EBITDA of $203,753 per year.

Since the company in this example is paying the actual costs of the insurance and taxes, there is no need to make an adjustment for that. However, if the company is a tenant in a multi-tenant building owned by the same owner of the company, the comparison of the rent is the same, but there is a potential for the business to be paying all the taxes, insurance, and maintenance for the property, which would require additional adjustments.

-jpg.jpeg?width=270&name=Michael_MacInnes-14(1-1)-jpg.jpeg) Author

Author

Michael MacInnes

Associate Director

Benchmark International

T: +1 (813) 898 2350

E: Mmacinnes@benchmarkintl.com

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkIntl.com

Europe: Michael Lawrie at +44 (0) 161 359 4400 / Lawrie@BenchmarkIntl.com

Africa: Anthony McCardle at +27 21 300 2055 / McCardle@BenchmarkIntl.com

ABOUT BENCHMARK INTERNATIONAL

Benchmark International’s global offices provide business owners in the middle market and lower middle market with creative, value-maximizing solutions for growing and exiting their businesses. To date, Benchmark International has handled engagements in excess of $7B across various industries worldwide. With decades of global M&A experience, Benchmark International’s deal teams, working from 12 offices across the world, have assisted hundreds of owners with achieving their personal objectives and ensuring the continued growth of their businesses.

Website: http://www.benchmarkintl.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International