If your business is in or serves one or more of the 8,762 neighborhoods identified by your state’s governor as a “Qualified Opportunity Zone” under the 2017 federal tax legislation, new buyers will be entering the market for your company in the coming months and they will be looking to make some quick deals.

When the tax cut law passed, investors in these zones were granted numerous attractive tax benefits including:

- Deferment until 2026 of tax on capital gains from the sale of projects outside the zones if those profits were now invested in any zone

- A 15% reduction certain capital gains taxes

- No capital gains taxes on any investment held for at least 10 years

But acquirers of businesses never took advantage of the new opportunity. Reports came back to the Administration that the statute called for the Treasury Department to implement regulations laying out the details as to which investments would qualify and absent those regulations there was too much concern that the “investments” would only cover real estate acquisitions and improvements.

Seeing that the real estate industry had wholeheartedly undertaken the desired action - investing in the zones – and wanting other investors such as acquirers of businesses to do the same, the President publicly released draft regulations last Wednesday.

The M&A investment community is quite pleased with the breadth and clarity of the regulations and appear to be jumping into action to exploit the new guidelines. And their action will likely be immediate. The incentives are set to cover only those investments made by the end of 2019.

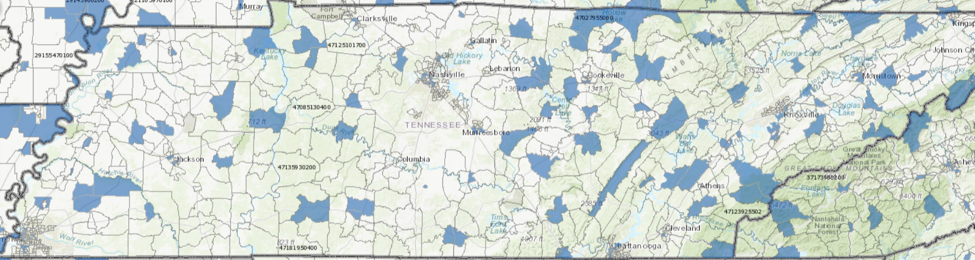

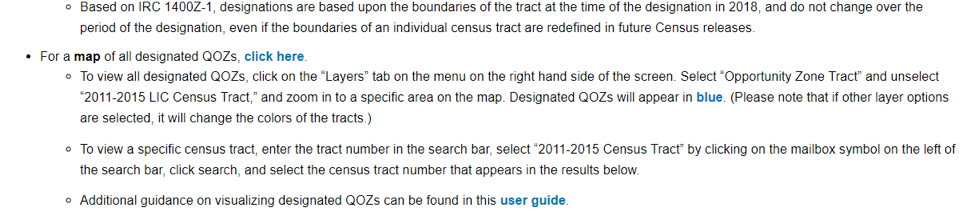

To view all Qualified Opportunity Zones to see if your business may qualify, visit the IRS’s map here. https://www.cims.cdfifund.gov/preparation/?config=config_nmtc.xmland follow these instructions. https://www.cdfifund.gov/Pages/Opportunity-Zones.aspxAs this map of Tennessee demonstrates, you might be surprised which areas are covered. The official method of designation is by “census track” and you can also search this website by your track – if you know it.

The regulations remain complex as there are a number of independent ways for an operating business to qualify based on where income is generated, where labor is provided, where services are provided, where working capital is invested, and where tangible property is maintained – among others. But business acquirers are getting ahold of the new details, have the firepower to get command of them, and will very quickly be refocusing their searches in light of these significant benefits.

There is still time to get your business on the market to take advantage of this increased interest and the potential boost to your sale price that it should also carry with it. Eight months from engagement to closing is not difficult with a properly motivated seller and buyer – and nothing motivates people like tax breaks!

Author

Author

Clinton Johnston

Managing Director

Benchmark International

T: +1 813 898 2350

E: Johnston@benchmarkcorporate.com

WE ARE READY WHEN YOU ARE

Call Benchmark International today if you are interested in an exit or growth strategy or if you are interested in acquiring.

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkCorporate.com

Europe: Carl Settle at +44 (0)161 359 4400 / Settle@BenchmarkCorporate.com

Africa: Anthony McCardle at +2721 300 2055 / McCardle@BenchmarkCorporate.com

ABOUT BENCHMARK INTERNATIONAL

Benchmark International’s global offices provide business owners in the middle market and lower middle market with creative, value-maximizing solutions for growing and exiting their businesses. To date, Benchmark International has handled engagements in excess of $5B across 30 industries worldwide. With decades of global M&A experience, Benchmark International’s deal teams, working from 13 offices across the world, have assisted hundreds of owners with achieving their personal objectives and ensuring the continued growth of their businesses.

Website: http://www.benchmarkcorporate.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International