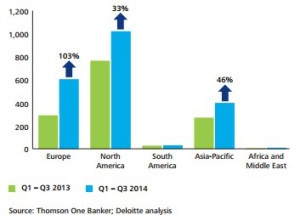

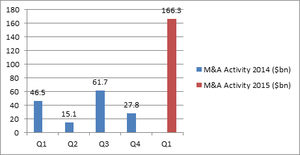

M&A activity in the third quarter of 2015 saw deal making achieve more than $1tn. This, with a combined value of mergers and acquisition over the past 9 months shows a 32% increase (compared to last year’s period) to £3.17tn. This puts global deal making on track to reach an all-time record in 2015, suggesting there is no better time to sell.

READ MORE >>Archives

Booming M&A Activity Across Sectors Continues Puts Global Deal Making on Track to Reach an All-Time Record in 2015

Foreign Investment Up All Round: Mergers Put UK Top of FDI Table For First Time Since 1977

Provisional figures from the United Nations Conference on Trade and Development show that the UK received more inward investment than any other nation last year. This puts the UK at the top of the foreign direct investment (FDI) table for the first time since 1977, with a large part of this FDI coming from merger and acquisition activity.

READ MORE >>Share this:

M&A Frenzy

According to analysts, a mergers and acquisitions frenzy is sweeping the UK. This follows a surge of M&A activity in the gambling sector that has seen a number of significant deals completed, including a £2.3bn deal between Ladbrookes and Gala Coral in July, and a £6bn merger of Betfair and Paddy Power in August. In total, between January and August this year, there have been more takeovers and mergers in the UK gambling sector than in any other country in the world.

READ MORE >>Share this:

Confidence Breeds M&A Buoyancy

At the start of 2015 the level of global deal making passed $3 trillion, 0.7% shy of the record set in 2007. Research by KPMG has found that the activity shows no sign of slowing as predictions have already been made surrounding global M&A topping $3.4 trillion by 2017. An increase of 26% based on the results from 2015.

READ MORE >>Share this:

Milestone Operations Acquired By Staffline

Benchmark International is pleased to announce the successful sale of Milestone Operations to Nottingham-headquartered recruitment firm Staffline Group.

READ MORE >>Share this:

BENCHMARK INTERNATIONAL NOMINATED FOR UK AND USA M&A AWARDS

2015 has been an exciting and prosperous year for Benchmark International and clients alike, bolstered by the M&A industry’s continued resurgence.

READ MORE >>Share this:

Pharma Market Infected with M&A Fever

Chemistry World recently reported that M&A activity in the pharmaceutical sector has reached fever pitch, with the announcement of a $1 billion deal in which Valeant Pharmaceuticals acquired Sprout.

READ MORE >>Share this:

How Family Members Will Deliver Future Business Success

In the latest in our blog series on the impact of family ownership on succession planning for businesses, we look at how complex emotions can result in difficult decision making for businesses owners in terms of exit prospects.

READ MORE >>Share this:

Top Universities Launch Programme to Assist China’s Family Businesses

China is the world’s second-largest economy, second only to the United States, and one where the private sector is dominated by family businesses.

READ MORE >>Share this:

Outsiders Take Away Family Business “X Factor”, Says Timpson

In a recent Telegraph column, John Timpson, fourth generation chairman of multi-service retailer Timpson, criticised the idea of bringing outside professional managers into family businesses, stating they are at risk of losing their “x factor”.

READ MORE >>Share this:

Benchmark International Facilitated The Transaction of Central Emergency Medical Services Inc. to Priority Ambulance

Benchmark International has successfully negotiated the sale of Central Emergency Medical Services to Priority Ambulance, a portfolio company of Enhanced Equity Funds. The transaction represents the conjoining of two of the strongest players in the EMS industry in the Southeast US.

Based in Atlanta, Central EMS provides advanced life support, basic life support, critical care and nonemergency transport options from 13 stations throughout the state. Eight stations are located in the Atlanta metro area and its surrounding counties. Central EMS also serves Northeast Georgia from an Athens location; Central Georgia from Macon, Dublin and Newnan stations; and Southeast Georgia from a station in Savannah.

Central EMS transports approximately 50,000 patients annually with 77 ambulances. The company specializes in ambulance transport service between hospitals and other health care facilities, assisted living facilities, skilled nursing facilities and long distance transports, as well as contracts for special event medical coverage. Central EMS currently employs more than 340 EMTs, paramedics, communication and billing specialists.

Based in Knoxville, Tenn., Priority Ambulance provides the highest level of clinical excellence in emergency and nonemergency medical care to the communities it serves. Throughout its national service area, more than 1,000 highly trained paramedics and EMTs staff more than 170 state-of-the-art ambulances with the latest medical equipment and technology.

Priority Ambulance provides emergency and nonemergency medical transport options to communities in Tennessee, Alabama, New York, Pennsylvania, Indiana and Georgia. Operating as Priority Ambulance, the company serves Knox, Loudon and Blount counties in East Tennessee. Priority Ambulance operates as Kunkel Ambulance in Utica, New York; as Trans Am Ambulance in Olean, New York; as Shoals Ambulance in Alabama; as Seals Ambulance in Indiana; and as Central EMS in Georgia.

Dara Shareef, Director at Benchmark International, stated, “It was a pleasure to represent Central Emergency Medical Services in this transaction. Combining management teams with hundreds of years of experience, backed by a strong private equity investor we believe the partnership with Priority Ambulance will be extremely successful within the EMS industry. We wish both parties the best of luck moving forward.”

Graham Woodard, Senior Associate at Benchmark International, stated, “Benchmark’s ability to create a competitive bid process for our client was instrumental in this transaction. At the end of the day, we believe our client found the perfect fit to continue and grow in the EMS industry and preserve a merited legacy.”

Central Emergency Medical Services Founder and CEO, Gary Coker, stated, “I am extremely pleased with the partnership that we have developed with Priority under the guidance of Benchmark International. I believe that the Central EMS and Priority Ambulance combined management teams will be able to deliver powerful results within the industry. I would like to thank all the members of the Benchmark International transaction team that worked diligently to produce this result and feel strongly we could not have achieved this without them by my side every step of the way.”

READ MORE >>Share this:

Preparing for a Transaction – Expect the unexpected

In many cases, mid-market business owners and entrepreneurs, like you, only go through the mergers and acquisitions process once in a lifetime. It’s difficult to know what to expect from a transaction, and business owners often, unknowingly, limit their chances of achieving an ideal outcome for what will likely be the biggest deal of their lives.

READ MORE >>Share this:

M&A heating up over the summer

The 2015 summer so far has seen an unprecedented ‘heat wave’ across the M&A industry. Despite many business owners and acquirers packing their bags to jet off on their holidays, deal activity remains robust. By September proposed global M&A deals could reach a trillion dollars, beating the previous high in 2007.

READ MORE >>Share this:

BSW Consulting (Exeter) Limited acquired by Parkwood Consultancy Services Limited

Benchmark International has advised on the successful sale of BSW Consulting (Exeter) Limited (BSW) to Parkwood Consultancy Services Limited (PCS) for an undisclosed sum.

READ MORE >>Share this:

Protean Software acquired by Foresight Group

Benchmark International is delighted to announce the successful sale of Protean Software Limited (Protean) to Foresight Group (Foresight) in a £4 million deal.

READ MORE >>Share this:

Managed Fleet Services acquired by The Davies Group

Benchmark International is pleased to announce the successful sale of Managed Fleet Services Limited (MFSL) to The Davies Group for an undisclosed sum.

READ MORE >>Share this:

Blood is Thicker than Water: Exiting Family Business

According to PwC’s latest Global Family Business Survey, only 16% of the 2,378 businesses interviewed had a documented succession plan in place. It is particularly important for those involved in a family business to consider an exit strategy at the earliest possible stage, especially as the Business Families Foundation reports that only 13% of family businesses make it to the third generation.

READ MORE >>Share this:

Safety & Technical Hydraulics Limited acquired by ATR Group

Benchmark International has advised on the successful sale of Safety & Technical Hydraulics Limited (Safety & Technical) to ATR Group (ATR) for an undisclosed sum.

READ MORE >>Share this:

UK Budget July 2015: What this means for your business

"The British economy I report on today is fundamentally stronger than it was five years ago. We're growing faster than any other major advanced economy. Our businesses have created two million more jobs" – these were the words from Chancellor of the Exchequer, George Osborne, as he gave the first Conservative Budget since May’s General Election victory.

READ MORE >>Share this:

Top tips for preparing to sell your IT business

Oculus, the virtual subsidiary of Facebook, has purchased British firm Surreal Vision as part of a drive to acquire virtual reality-focused businesses. The team at Surreal Vision is said to be moving to Washington to work at the Oculus lab. So how do small IT businesses get on the radar of the bigger companies if their owners have acquisition on their mind? Here are some top tips for you if you are considering selling your IT business and want to ensure that you attract the best buyers.

READ MORE >>Share this:

The Canopy Company acquired by Acme Facilities Group

Benchmark International has advised on the successful sale of The Canopy Company Limited (The Canopy Company) to Acme Facilities Group Limited (Acme Group) for an undisclosed sum.

READ MORE >>Share this:

Record month at Benchmark International

June saw Benchmark International complete a record month, generating in excess of $11 million (£7 million) in actual company revenue, across 14 deals completed. The combined transaction values totalling in excess of $360 million (£235 million).

READ MORE >>Share this:

Deal values rise despite a drop in merger and acquisition volumes

A report recently released by Experian has indicated that the volume of merger and acquisition transactions across the UK, Europe, USA and Asia Pacific region dropped by 8% in April 2015. The total number of deals fell from 1,838 in March of this year, to 1,787 in April.

READ MORE >>Share this:

Building your business and getting the most out of deal values

It was Steve Jobs of Apple who once said: "Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven't found it yet, keep looking. Don't settle. As with all matters of the heart, you'll know when you find it."

READ MORE >>Share this:

Benchmark International wins the ‘International Mid-Market Corporate Finance Advisory of the Year’ award for a second year running

In recognition of recent efforts, Benchmark International is the proud recipient of the ‘International – Mid-Market Corporate Finance Advisory of the Year’ award for a second year running at the ACQ Global Awards 2015.

READ MORE >>Share this:

Benchmark International winner at AI M&A Awards

Benchmark International is delighted to announce it has been named winner of the AI M&A Awards ‘Best for Acquisition Strategy 2015 - UK’ at the Acquisition International Awards 2015.

READ MORE >>Share this:

Industry Outlook: Telecommunications

As digital technology has changed the way in which the UK population communicates, the telecommunications industry has had to adapt and diversify its services to remain relevant.

READ MORE >>Share this:

The Art of Due Diligence - Part 3

Benchmark International Advises on the Sale of Complete Limited to Sparks Commercial Services

Benchmark International is pleased to announce the sale of Complete Limited to Sparks Commercial Services.

READ MORE >>Share this:

Benchmark International nominated at Awwwards event

Benchmark International is delighted to announce that our new website has been nominated for this year’s prestigious Awwwards prize, following our successful rebranding earlier this year.

READ MORE >>Share this:

Benchmark International opens Oxfordshire office

At Benchmark International, we’re proud to be celebrating an exciting year of strategic growth and an increase in headcount by opening brand new offices in Milton Park, Oxfordshire.

READ MORE >>Share this:

Arblaster & Clarke acquired by Specialist Tours Limited

Benchmark International is delighted to announce the successful sale of Arblaster & Clarke Wine Tours Limited (Arblaster) to Specialist Tours Limited (Specialist Tours) for an undisclosed sum.

READ MORE >>Share this:

Benchmark International Facilitates the Transaction of RX30 to GTCR

Strategic Investment in Leading Developer of Pharmacy Management Software

Benchmark International’s Major Transaction Team had the opportunity to represent Transaction Data Systems, Inc., doing business as Rx30 ("Rx30"), in a transaction with new investor GTCR completed on Monday. GTCR’s strategic equity investment in Rx30 will accelerate Rx30’s new product development and continued growth. Rx30's CEO, Steve Wubker, and the existing management team will continue to lead the company.

Rx30 is a leading national developer and supplier of vertical enterprise software that offers pharmacy management software solutions to the independent, hospital, long-term care and specialty pharmacy markets. Dedicated to the independent pharmacy market for the last 35 years, Rx30 offers a suite of market-leading software solutions to enable prescription filling, pharmacy management and other critical functions for its pharmacist customers.

Kendall Stafford, Managing Director of Benchmark International, stated, “It was a pleasure to advise Rx30 on this transaction. It was important for CEO Steve Wubker and the existing management team to partner with an equity investor that would add both healthcare and technology expertise to help accelerate the growth of the company. GTCR was the perfect fit. The transaction allowed the founding shareholders to exit happily at close, knowing their company is in good hands, with the existing management team continuing to grow the business and a new equity partnership in place to support their vision. It will be an exciting road forward for Rx30 and we were fortunate to be a part of the company’s growth and starting this next chapter. We wish each party the best of luck.”

If you are considering a strategic partnership or exit, Benchmark International should be your first call.

Share this:

Systems Up acquired by iomart Group

Benchmark International is delighted to announce the successful sale of Systems Up Limited (SystemsUp) to iomart Group plc (iomart) in a deal worth up to £13 million.

READ MORE >>Share this:

Mergers & Acquisitions following the General Election

The dust is finally settling on the post-election period. The build up to the election was marked by low levels of activity prompted by uncertainty for investors, so recent ONS statistics delivering the news that Q1 of 2015 had historically low-levels of M&A activity in the UK should come as no surprise. As the Conservative party has secured its first majority for over two decades and is poised to deliver their first budget next month on the 8th July, Benchmark International reviews the press to see what business publications are saying about UK M&A activity in light of the Tory victory.

READ MORE >>Share this:

The Art of Due Diligence - Part 2

The biggest fear for any buyer in an M&A transaction is purchasing a problem rather than a solution.

READ MORE >>Share this:

The Art of Due Diligence - Part 1

This is the first of three blogs that will give you, the business owner looking to sell your company, an insight into the art of due diligence and its important in the M&A process.

READ MORE >>Share this:

10 steps to maximise the value and saleability of your business - Step 10

Throughout our 10 blog series, we have discussed the different processes and stages recommended for you, a business owner, to take that could make your company more valuable and saleable.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Yeovil Plumbing Supplies Limited to the Bradfords Group

Benchmark International is pleased to announce the sale of Yeovil Plumbing Supplies Limited to the Bradfords Group.

READ MORE >>Share this:

General Election – what does a Conservative government mean for your business?

David Cameron has vowed to lead a government for “one nation” and will make “Great Britain greater” after securing the 326 seats needed for the first majority Conservative government since 1992.

READ MORE >> Benchmark International

Benchmark International  Benchmark International

Benchmark International