Due diligence by potential buyers takes up a serious amount of time in any M&A process. Essentially, it’s designed to make sure the buyer knows exactly what it is that they’re buying – and in other cases, ‘reverse diligence’ helps the target company understand whether a potential buyer or merger partner is right for them.

READ MORE >>Archives

Due Diligence in Mergers and Acquisitions: A Beginner’s Guide to the Top Five Areas of Interest

Benchmark International Opens Ireland Office

Benchmark International is pleased to announce that after an exciting year of growth, we are expanding our international reach to Ireland.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Furlong Business Solutions Limited to Volaris Group

Benchmark International is pleased to announce the sale of Furlong Business Solutions to Volaris Group.

READ MORE >>Share this:

Post-Brexit Benefits for Mergers and Acquisitions

Irrespective of the outcome and the eventual deal Britain strikes with the EU, there will be greater uncertainty for businesses in the near-term.

READ MORE >>Share this:

The Five Most Common Seller Mistakes in M&A Deals

‘To err is human’, it’s said … but for sellers and buyers alike, the M&A process is surely not a good time to make mistakes.

READ MORE >>Share this:

What Do Major Mergers and Acquisitions Mean for Small Retailers?

It seems as though every other day, the headlines announce a new acquisition among major retailers. The giants in the industry are diversifying their products, sucking up more stock, and building mighty kingdoms that boutique and small business owners can’t even throw stones at. How can these smaller businesses possibly compete? First, take a look at what’s happening…

READ MORE >>Share this:

The Importance of Disclosure Schedules In Mergers & Acquisitions

Disclosure schedules are an integral part of any merger or acquisition (M&A) transaction. They contain information required by the acquisition agreement—typically a listing of important contracts, intellectual property, employee information, and other materials as well as exceptions or qualifications to the detailed representations and warranties of the selling company contained in the acquisition agreement.

READ MORE >>Share this:

Timing: A Critical Factor in M&A

Timing is, without doubt, one of the most critical factors in mergers and acquisitions; a recent report found that it is, in fact, the single most reliable predictor in terms of creating real shareholder value.

READ MORE >>Share this:

ROC Northwest Client Testimonial {Video}

To Sell or Not to Sell: The Top Four Reasons Entrepreneurs Choose to Sell

Entrepreneurs, by nature, are people who spend a considerable amount of time looking for the next opportunity. And for them, 'the next opportunity' often includes a suitable time to sell their company.

READ MORE >>Share this:

Out of Africa: How the M&A Market is Evolving South of the Sahara

Benchmark International has recently opened a new office in Cape Town, South Africa (see 3rd July blog post), headed up by Andre Bresler and Dustin Graham. This is an exciting development for Benchmark International, in a dynamic evolving market.

READ MORE >>Share this:

Europcar Looks to Boost Low-Cost Presence With Goldcar Deal

French rental car company, Europcar has made its fourth acquisition of the year in the form of Europe's largest low-cost car rental agency, Goldcar.

READ MORE >>Share this:

Hewlett Packard Sees Acquisitions As Integral to Growth

California-based Hewlett Packard Enterprise has been busy bolstering its portfolio to stay ahead in cloud computing, with even more acquisitions on the horizon.

READ MORE >>Share this:

Competition Watchdog Clears Path for Asset Management Mega Merger

Britain's Competition and Markets Authority (CMA) has given the go-ahead for the £11 billion merger of Scotland-based asset management companies Standard Life and Aberdeen Asset Management.

READ MORE >>Share this:

RPC Group's Profits Soar Following Acquisitions

RPC, the international design and engineering company, has cited recent acquisitions in the last financial year as key factor in its profits more than doubling.

READ MORE >>Share this:

Benchmark International wins ‘International Mid-Market Corporate Finance Advisory of the Year’ for a third time

Benchmark International is proud to announce that it has, once again, been named ‘International Mid-Market Corporate Finance Adviser of the Year’ at the annual ACQ Global Awards.

READ MORE >>Share this:

Benchmark International Expands Into South Africa

A Manchester-based M&A specialist has expanded into South Africa with the opening of an office in Cape Town.

READ MORE >>Share this:

Chemical Giants Set For $14 billion Merger

After years of approaches, US-based Huntsman Corp and Switzerland’s Clariant AG have announced that they will merge to create a chemicals manufacturer worth more than $14 billion.

READ MORE >>Share this:

Amazon.com to acquire Whole Foods Market Inc

Amazon has announced it will acquire upmarket grocer, Whole Foods Market Inc, for $13.7 billion in a deal that includes the company's debt. Expected to close late 2017, the deal will not only be the largest in the online retailer’s history, but also a major step in expanding into bricks-and-mortar retail.

READ MORE >>Share this:

Linde and Praxair Merger to go Ahead

Last week it was announced that German chemicals giant Linde have signed a formal agreement for a €70bn deal with US industrial gases company Praxair, despite worker representatives opposing the merger.

READ MORE >>Share this:

Microsoft Continues to Look to Israel for Cyber Safety

American computing giant Microsoft continues to expand its acquisitions of Israeli-based software companies, with a reported $100 million deal for cybersecurity start-up Hexadite.

READ MORE >>Share this:

Apple Continues Acquisition Trail with Lattice.io

Following news last week that Apple had completed a deal to acquire sleep-tracking device company Beddit, the tech behemoth has completed yet another acquisition in the form of Lattice.io.

READ MORE >>Share this:

Chemicals Sector Continues to Remain Buoyant

Following our report last month on the $130bn mega-merger between US chemical giants Dow Chemical and DuPont, a new deal has announced the creation of a chemicals giant with a market value of approx $14 billion. This latest high-profile transaction across the diversified chemicals sector sees companies are striking ever more aggressive deals to find new ways to slash costs and gain greater scale of their segments, typifying the current market trend for companies to cut costs and boost revenue.

READ MORE >>Share this:

Lavazza Weighs M&A Options in a Strengthening Coffee Market

Italy’s largest coffee group by sales, Lavazza now have the capacity to spend up to €2bn on acquisitions to further its global ambitions within a strong industry dominated by Nestlé and JAB of Switzerland.

READ MORE >>Share this:

Apple Gets Into Beddit With Latest Acquisition

Last week it was revealed that Apple had completed a low-key deal to acquire Beddit, a Finnish company that makes sleep-tracking devices compatible with apps for both iOS and the Apple Watch.

READ MORE >>Share this:

Coach Bags Kate Spade

New York design house of modern luxury accessories and lifestyle brands, Coach Inc has acquired its rival Kate Spade & Company for $2.4 billion, a figure “not justified strictly by the numbers” according to the New York Times.

READ MORE >>Share this:

An Apple/Disney Merger on the Cards?

Apple has hit the headlines this week with the media speculating whether or not they are set for a mammoth acquisition due to its significant and ever-growing stash of cash.

READ MORE >>Share this:

SiriusXM Gets Connected With Automatic in $100 Million Deal

This week it was announced SiriusXM would acquire San Francisco-based connected car company Automatic Labs Inc. in a deal worth $100 million, according to TechCrunch.

READ MORE >>Share this:

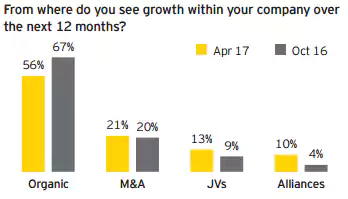

UK Companies Set For A Rampant 12 Months Of M&A Activity

According to a recent report, UK companies are braced for a surge in deal-making this year, as executives prepare their businesses for life away from the European Union.

READ MORE >>Share this:

Exova to be bought by Element Materials in £620m deal

After several weeks of speculation, it has been announced that global lab testing specialist Exova has accepted an all-cash takeover from its industry rival Element Materials Technology Group.

READ MORE >>Share this:

Becton Dickinson acquires C.R. Bard in $24 billion deal

In the biggest deal of the company’s 120-year history, medical device giant Becton, Dickinson & Company has announced its acquisition of C.R. Bard for $24 billion.

READ MORE >>Share this:

Beware of Strangers Bearing Gifts

It appears many buyers are once again attempting to bag bargain acquisitions by exploiting business owners blinded by multi-million pound cheques and disadvantaged by a lack of advice from a seasoned M&A professional.

READ MORE >>Share this:

Best in Show: PetSmart to Acquire Chewy in Record Breaking Deal

This week, PetSmart announced its intention to acquire fast-growing pet food and product site Chewy.com in a deal alleged to fetch $3.35 billion, surpassing Walmart’s $3.3 billion purchase of Jet.com to become the biggest e-commerce deal ever.

READ MORE >>Share this:

Most Important Deal of the Day: Post Holdings Acquires Weetabix

Following months of speculation, it was confirmed last week that US cereal giant Post Holdings is to acquire British cereal company Weetabix in a deal worth £1.4 billion.

READ MORE >>Share this:

M&A Fuels Growth in Gasoline and Industrial Mining Sectors

7-Eleven Inc, the premier name and largest chain in the convenience-retailing industry, recently announced that it has entered into an asset purchase agreement with Sunoco LP. As part of the agreement, 7-Eleven will acquire approximately 1,108 convenience stores located in 18 states.

READ MORE >>Share this:

Chemicals Sector Forges Ahead in M&A Activity

In a move announced on 5th April 2017 and comes hot on the heels of last month’s high profile DowDuPont mega-merger, valued at $130bn, ChemChina has won conditional EU antitrust approval for its $43 billion bid for Syngenta, a Swiss pesticides and seeds group.

READ MORE >>Share this:

Benchmark International Facilitated the Transaction of Label Express Limited to Lynx Equity

Benchmark International is pleased to announce the sale of Label Express Limited to Lynx Equity, a world-renowned manager of private equity funds based in Canada with a diversified portfolio of companies throughout North America.

For the past decade Lynx Equity has focused on 100% acquisitions of old-economy, North American businesses, before entering into the European market at the beginning of 2017. Benchmark International assisted Lynx Equity with the successful acquisition of London-based SignalHome in February, and, with the purchase of Label Express, it is clear that the acquisition trail is proving fruitful.

Established over 30 years ago, Label Express is an industry leading provider of express labelling services, including in-house manufacturing and studio capabilities, to a wide range of underserved niche industries. The company’s strong customer service and sales departments have helped to consistently drive growth over the last seven years, and, today, Label Express is proud to be the label supplier of choice to its many clients.

Roger Forshaw, Associate Director at Benchmark International, who headed up the deal commented, “I am absolutely delighted that we’ve managed to find our clients an acquirer that not only shares the same ethos they instilled over 30 years ago, but also a buyer that will ensure the Label Express name continues long into the foreseeable future. This is made even more satisfying given our clients’ previous attempts to secure a suitable acquirer over the last three years – we are pleased that our efforts made the difference and resulted in a success story for all concerned. I would like to wish my clients all the best with the next chapter of their lives”.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Scan Alarms & Security Systems Limited to Secom PLC

Benchmark International are pleased to announce that a deal has been agreed for the sale of Scan Alarms & Security Systems Limited to Secom PLC.

READ MORE >>Share this:

Benchmark International Advises on the Deal Between Hi-Tech Products Limited to Siegwerk

Benchmark International are pleased to announce that a deal between Hi-Tech Products Limited and Siegwerk has been agreed.

READ MORE >>Share this:

Food sector M&A ripe for the picking

In the biggest deal to date in the natural and organic foods category, and in its largest takeover since 2007, French food company Danone is set to double the size of its US business this month with the acquisition of US organic food producer WhiteWave Foods. This included significant run-rate EBIT synergies of $300 million by 2020, an improvement of Danone’s full year like-for-like sales growth by an extra 0.5 percent to 1 percent, an increase of EBIT margin from 2018 and solid EPS improvement from 2017 and above 10 percent based on run-rate synergies.

READ MORE >> Benchmark International

Benchmark International  Benchmark International

Benchmark International