Introduction

There has been significant growth in the number of Employee Ownership Trusts (EOTs) in recent years, and in this article I explore some of the differences between shareholders selling to a trade buyer and selling to a trust set up for this purpose.

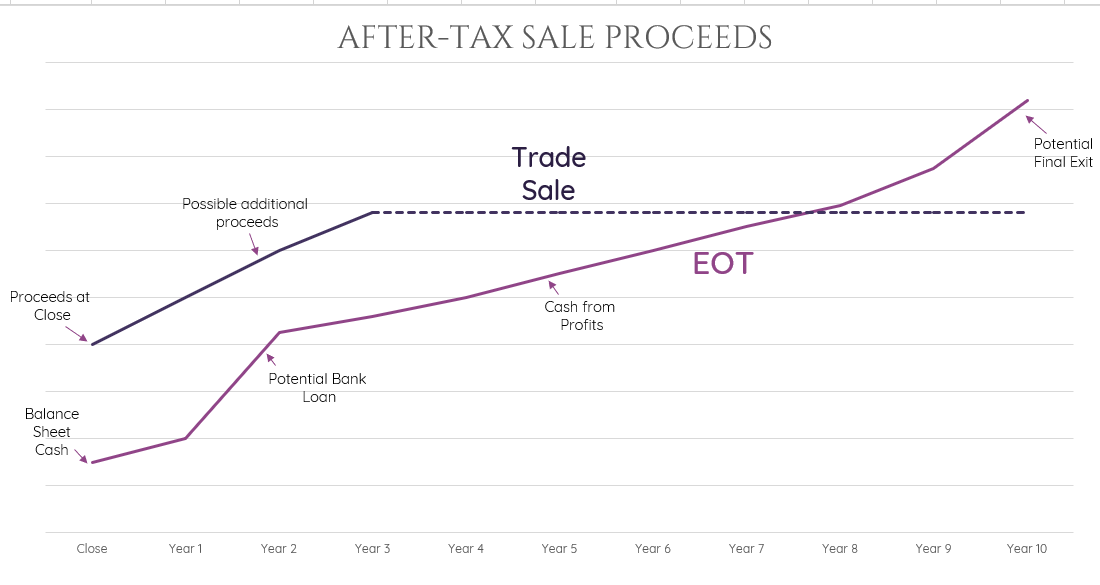

Note: Visual based on a number of assumptions including exit multiples, earnings/cash flow and different tax rates.

What is an EOT?

An EOT is a trust set up for the benefit of a company’s employees that purchase shares from shareholders as part of a shareholder exit strategy. The stipulations are complex, but notably the shareholders must sell at least 51% of the company’s shares, and in return they will benefit from a Capital Gains Tax (CGT) rate of zero percent (compared to a normal CGT rate of 20% on a trade sale).

What are some of the Advantages of an EOT?

- A CGT rate of zero percent.

- Employees can receive a tax-free bonus of £3,600 per annum.

- The Enterprise Value might be higher than in a trade sale.

- Sellers can have more control over the process as opposed to in a trade sale.

- There is no requirement for managers to take a stake, as may be the case with a management buy-out, and also no requirement to raise debt at completion.

- Employees can be highly engaged and motivated for the future of the business.

- Professional costs, such as legal and taxation (for HMRC clearances), may be lower than with a trade sale.

What are some of the Disadvantages of an EOT?

- There may be less cash at completion than with a trade buyer, as a trade buyer would be required to pay a significant premium at completion to take ownership and control.

- EOTs are only normally suitable when a company has significant free cash, with which to kick-start the EOT. Without this, a debt-raising exercise would normally be required.

- There are stringent requirements including the appointment of an independent trustee and ongoing running of the trust which are often overlooked by sellers.

- Where a seller retains a shareholding, as opposed to selling 100% to the EOT, there may be difficulties in extracting value for this retained shareholding down the line.

Point of View!

Where a shareholder has a genuine desire to see their company effectively owned by the employees, EOTs can be a great way of achieving this. Examples such as The John Lewis Partnership (technically not an EOT, actually) and Richer Sounds are great examples of this. And the nil CGT rate can be a great bonus (caveat where an EOT is used simply to achieve a nil CGT rate on sale, the motives of the sellers become questionable and inevitably the success of the EOT cannot be guaranteed).

Although here at Benchmark International we have facilitated a number of successful EOTs, the favoured route for most shareholders is a trade sale, normally to a strategic buyer. A trade sale is always likely to achieve the greatest value on completion and a speedier exit for the shareholders. With CGT rates in the UK no greater than 20%, this is still a low tax outcome.

Additionally, HMRC announced in April 2023 that it intends to publish a consultation later in the year on the effectiveness of the EOT tax regime. This is to ensure the reliefs are targeted closely at incentivising EOTs and an employee ownership business model whilst preventing the reliefs from being used for unintended tax planning.

With that in mind, a seller needs to ensure that an EOT is conducted for the right reasons, not solely for tax benefits.

If you wish to talk through any of the above, please feel free to drop me a line.

Author

Alex Forshaw

Associate Director

Benchmark International

T: +44 (0) 161 359 4400

E: AForshaw@benchmarkintl.com

Europe: Michael Lawrie at +44 (0) 161 359 4400 / Lawrie@BenchmarkIntl.com

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkIntl.com

Africa: Anthony McCardle at +27 21 300 2055 / McCardle@BenchmarkIntl.com

ABOUT BENCHMARK INTERNATIONAL

Benchmark International is a global M&A firm that provides business owners with creative, value-maximizing solutions for growing and exiting their businesses. Benchmark International has handled over $8.25 billion in transaction value across various industries from offices across the world. With decades of M&A experience, Benchmark International’s transaction teams have assisted business owners with achieving their objectives and ensuring the continued growth of their businesses. The firm has also been named the Investment Banking Firm of the Year by The M&A Advisor and the #1 Sell-side, Privately Owned M&A Advisor in the World by Pitchbook’s Global League Tables.

Website: http://www.benchmarkintl.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International

-_Social.jpg?width=1200&height=1200&name=Trade-Sale-or-Sale-to-Employees-(in-the-UK)-_Social.jpg)