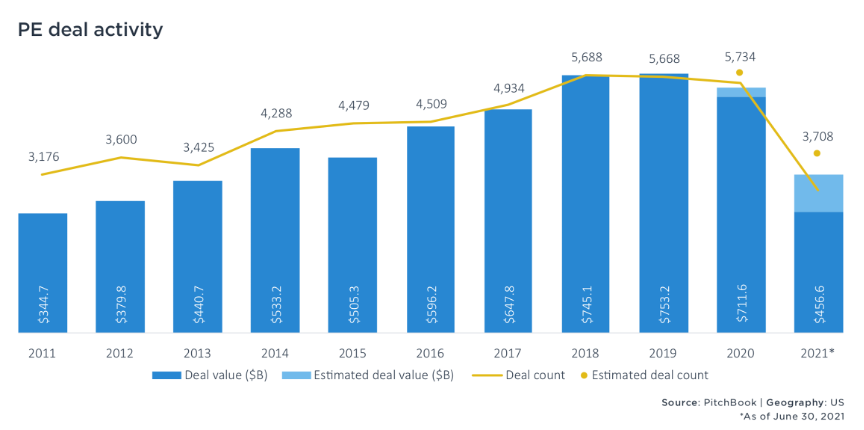

Data released in a recent report by Pitchbook shows the unprecedented performance of U.S. Private Equity (PE) during the first half of 2021, continuing its intense pace for the third quarter in a row. PE firms closed on 3,708 deals worth a combined $456.6 billion. That’s almost two-thirds of the $711.6 billion deal value recorded in the entire year of 2020, and the two years prior.

What’s Driving PE Fever?

The onslaught of deals in both the $1 billion+ and middle-market ranges has been stimulated by several factors:

- Sustained economic recovery

- Falling unemployment claims

- High-yield debt due to low treasury yields

- Plenty of dry powder on the buy side

- The possibility of a 20% to 39.6% capital gains tax hike

- Elevated pricing on the sell side

This year, institutional investors pivoted from the conservative decision-making of 2020. Funds of all sizes, including middle-market managers and first-time funds, are seeing their share of success thanks to this mounting appetite for PE.

Investor confidence remained high through Q2, as equity markets continued to move up and to the right. Even riskier firms have reaped the benefits, as the high-yield credit spread dropped to a post-global-financial-crisis low in June.

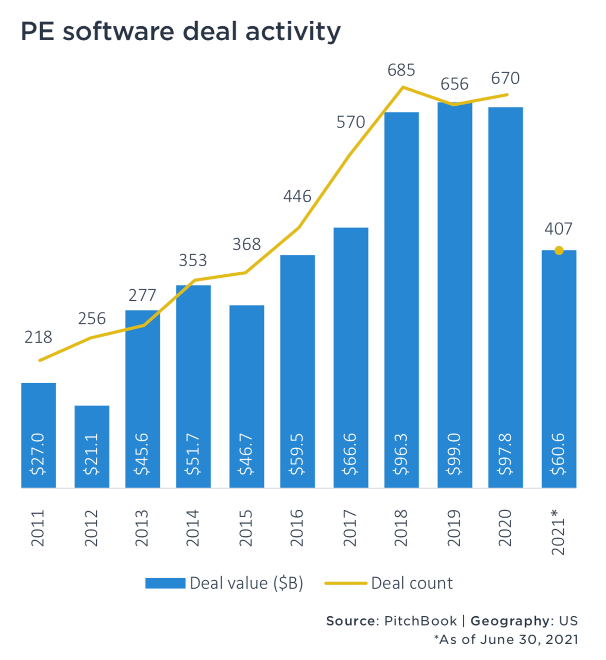

Stellar Performance in the Software Space

In 2021, PE deals in the software sector continued to draw capital at all new levels, with cybersecurity as an increasingly focused area of investment. Cloud-based cybersecurity services, in particular, are emerging as a major demand as companies continue to face the need for business infrastructure digitization and remote-work security challenges. Two other tech areas to watch will be network detection and response (NDR) and privileged access management (PAM).

Cybersecurity Receives More PE Focus

When it comes to cybersecurity, PE firms are enticed by the strong cash flow, revenue and customer based potential. Major players are restructuring to maintain this growth momentum and find their place among strong niche market opportunities. And, with the increasing occurrence of cyberattacks on U.S. businesses in the last year, cybersecurity is in the spotlight more than ever. President Biden recently signed an executive order to bolster cybersecurity, asking the private sector to work with the federal government to adopt a “zero-trust architecture,” which essentially means that devices should never be trusted by default, regardless of their previous verification or connection to a corporate network, in addition to real-time authentication. The zero-trust concept is expected to attract continued PE attention moving forward.

Healthcare Remains Active in PE

Another sector that is seeing continued PE opportunities is healthcare, including mental health providers and behavioral health services, as reimbursement rates are improving.

Prior to the pandemic, these services were increasingly culturally normalized, a trend that was also accelerated by the pandemic. PE firms are getting in on consolidation plays involving intellectual and developmental disabilities, autism services, and basic psychology services.

Clinical data sharing has also been demonstrated to be an emerging area of interest for PE. For years, both private and non-profit groups have been working to link clinical data with advance medical research. This is a challenging task because of privacy concerns, differing systems, and inconsistent data quality. PE firms may begin looking for opportunities in these areas for improved technology strategies.

PE Exit Activity

U.S. PE exit activity is also on pace for a record-setting year. Halfway through 2021, combined PE exit value already surpassed 2019’s annual total of $355.9 billion and there was a high level of 676 exits. Most of the exits are large with many as public listings.

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkIntl.com

Europe: Michael Lawrie at +44 (0) 161 359 4400 / Lawrie@BenchmarkIntl.com

Africa: Anthony McCardle at +27 21 300 2055 / McCardle@BenchmarkIntl.com

ABOUT BENCHMARK INTERNATIONAL

Benchmark International’s global offices provide business owners in the middle market and lower middle market with creative, value-maximizing solutions for growing and exiting their businesses. To date, Benchmark International has handled engagements in excess of $7B across various industries worldwide. With decades of global M&A experience, Benchmark International’s deal teams, working from 14 offices across the world, have assisted hundreds of owners with achieving their personal objectives and ensuring the continued growth of their businesses.

Website: http://www.benchmarkintl.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International

.jpg?width=1200&name=U.S._Private_Equity_Sets_Major_Record_For_H1_2021_Social(1).jpg)