The 13th annual survey conducted by Citizens Bank regarding the M&A outlook for 2024 points to the highest levels of optimism in several years for dealmaking activity this year. Solid expectations for the U.S. economy and rising enthusiasm among buyers underscore this much-welcomed optimism.

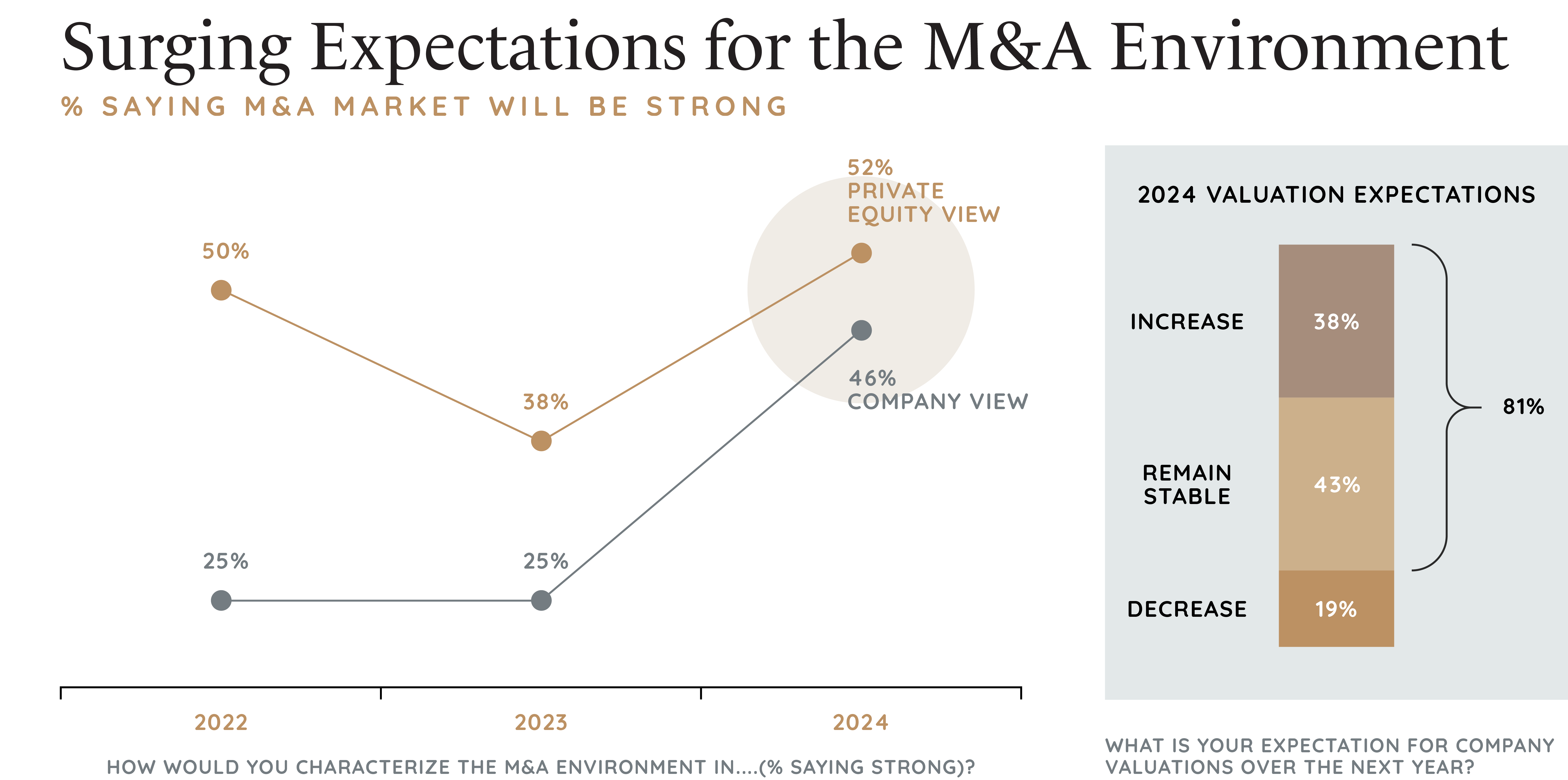

The survey, which included 400 middle market CEOs, CFOs, and Private Equity Principals, indicated that middle-market companies are the most optimistic that they have been since 2020, with 46% of respondents expecting to see a strong M&A market this year. Private equity firms appear to be even more positive, with 52% seeing strength in the current M&A market. This is up significantly from only 38% in 2023. Also, 46% of private equity firms expect higher deal volumes in 2024, while only 19% feel that deal flow could decrease. These positive numbers are evidence that normalcy is returning to the M&A market.

Fewer Operating Issues This Year

The good news is that fewer middle market companies face fewer operating obstacles, such as commodity prices, rising interest rates, and labor market issues in 2024. The overall economic outlook is also more optimistic than last year, with 46% of middle-market businesses and 50% of private equity firms expecting U.S. economic conditions to improve this year. Of those who expect a better economy, 68% are likely to engage in M&A activity in 2024.

Strong Buyer Enthusiasm

All of this is leading to growing buyer enthusiasm. Of the private equity executives who expect higher deal flow this year, 79% expect to buy more than last year, and only 21% expect to sell more. Among middle-market companies, the potential buyer pool also expanded for the second year, pointing to more balanced markets. Among buyers, 44% said financing and capital markets would aid their acquisition strategies this year.

Other Trends Supporting Economic Optimism

The survey also revealed notable trends showing growing interest in artificial intelligence (AI) assets and international dealmaking. The upcoming U.S. election is also driving buyer enthusiasm. A quarter of the private equity firms that expect higher deal flow this year are seeking to add AI assets to their portfolios.

Regarding international deal activity, 51% of sellers and 44% of buyers reported considering international deals this year. Private equity interest in international investment opportunities has increased year-over-year from 27% to 55%.

Then, there is the upcoming U.S. election in November. Uncertainty before the election could support more dealmaking in the year's first half. More respondents (41%) said that the pending election makes them more likely to pursue a transaction this year, with only 25% saying it makes them less likely.

About the Survey

The survey by Citizens Bank included 400 leaders from middle market companies ($50 million to $1 billion in revenue) and private equity firms (fund size less than $1.5 billion) in the United States. Senior executives at 277 middle-market companies in various industries, as well as 123 private equity firms who are directly involved in decisions related to M&A, completed the survey over the phone or online between November and December 2023.

Considering Exploring Market Opportunities?

If you are considering selling your company, 2024 is the time to act. Please get in touch with our M&A experts at Benchmark International to discuss how we can help you achieve the best deal possible.

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkIntl.com

Europe: Michael Lawrie at +44 (0) 161 359 4400 / Lawrie@BenchmarkIntl.com

Africa: Anthony McCardle at +27 21 300 2055 / McCardle@BenchmarkIntl.com

ABOUT BENCHMARK INTERNATIONAL:

Benchmark International is a global M&A firm that provides business owners with creative, value-maximizing solutions for growing and exiting their businesses. Benchmark International has handled over $10 billion in transaction value across various industries from offices across the world. With decades of M&A experience, Benchmark International’s transaction teams have assisted business owners with achieving their objectives and ensuring the continued growth of their businesses. The firm has also been named the Investment Banking Firm of the Year by The M&A Advisor and the Global M&A Network as well as the #1 Sell-side Exclusive M&A Advisor in the World by Pitchbook’s Global League Tables.

Website: http://www.benchmarkintl.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International