There may have never been a more difficult time to answer this question.

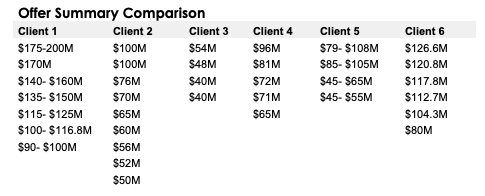

To start, the external factors weighing on valuation are, to put it gently, askew. COVID-19, supply chain disruption, inflation, rising interest rates, war, and changing bank regulations have all piled up to whipsaw not only the process of mergers and acquisitions but also the very tenets of routine business growth and risk. Essentially, these external factors have added a new slew of variables to each potential acquirer’s analysis of business value. The more variables, the wider the disbursement of valuations. The table below presents the formal offers received by the last six of Benchmark’s clients over the past two years.

These valuations were arrived at by professional acquirers seasoned in the industries under review and were based on very detailed financial information. The majority of buyers had held multiple discussions with the would-be seller and toured the target company’s facilities during the one-to-three-month review process that led up to their offer being made.

And yet, the valuations for each client range from double the low end on half of the opportunities to fifty percent above the low end on two others. A similar chart as recent as two years ago would have shown less than half this range in most cases.

The two key takeaways from this data are:

- Now more than ever, the key to achieving maximum valuation lies in a broad and intelligent outreach effort.

- The right question to ask before beginning the company sale process is not, “What’s my business worth?” but rather, “How can I get maximum value for my business?”

You may be wondering why this happened. Below are a few common issues that we have identified from the process of marketing our broad portfolio and selling nearly 400 businesses in the past two years.

- One analyst’s risk is another’s opportunity. The more variables in the equation, the more unique interpretations that the buyer’s valuation team can make. In other words, a recipe with only two ingredients is harder to get creative with than one with several ingredients.

- Owing to the macroeconomic turbulence ignited in 2019, most target companies have experienced increased volatility in revenues and margins. The lack of nice straight lines going up and up slowly over the last five years causes buyers to dig deeper and find issues they would not have seen in the “good old days” of pre-2020.

- Most of the people doing the buy-side valuation work on businesses of this size were not around the last time there were economic hiccups. They came of age in finance over the 11-year growth period leading up to COVID-19. They are therefore prone to overemphasize and misinterpret the interplay between recent turmoil and the future prospects of the businesses they are reviewing.

- The combination of higher interest rates and increased regulations on banks has led to tightness in the lending market. New players are moving in—non-banking lenders, to be specific—but this rearranging of the deckchairs means that some buyers are feeling pain when it comes to securing the debt portion of their purchase price while others are not.

- Lastly, there is a fair amount of opportunism that some buyers are seeking to exploit. Companies that have done well are “riding a temporary COVID bounce,” and companies that have had a one-time stumble are now labeled “inherently risky.” This is leading to bottom fishing from some but not all buyers.

So, what is your business worth? The best answer in today’s market is: “That depends on how much you are willing to invest in the process of finding the right buyer.”

This is what Benchmark International brings to the table. Taking careful steps to find the right buyer is what we do best. We have the largest funnel, the strongest process, and the best methods of achieving a closing. It’s about a better process that empowers us to get better results. And we only represent companies on the sell side, so we are 100% focused on your best interests as a business on the market and you can rely on us as your partner every step of the way. This methodology is a large part of why we successfully sell more than 200 companies per year, and why so many business owners like you choose Benchmark International to get them the most value in a sale.

Author

Clinton Johnston

Managing Director

Benchmark International

T: +1 813 898 2363

E: johnston@benchmarkintl.com

Americas: Sam Smoot at +1 (813) 898 2350 / Smoot@BenchmarkIntl.com

Europe: Michael Lawrie at +44 (0) 161 359 4400 / Lawrie@BenchmarkIntl.com

Africa: Anthony McCardle at +27 21 300 2055 / McCardle@BenchmarkIntl.com

ABOUT BENCHMARK INTERNATIONAL:

Benchmark International is a global M&A firm that provides business owners with creative, value-maximizing solutions for growing and exiting their businesses. Benchmark International has handled over $10 billion in transaction value across various industries from offices across the world. With decades of M&A experience, Benchmark International’s transaction teams have assisted business owners with achieving their objectives and ensuring the continued growth of their businesses. The firm has also been named the Investment Banking Firm of the Year by The M&A Advisor and the Global M&A Network as well as the #1 Sell-side Exclusive M&A Advisor in the World by Pitchbook’s Global League Tables.

Website: http://www.benchmarkintl.com

Blog: http://blog.benchmarkcorporate.com

Benchmark International

Benchmark International  Benchmark International

Benchmark International