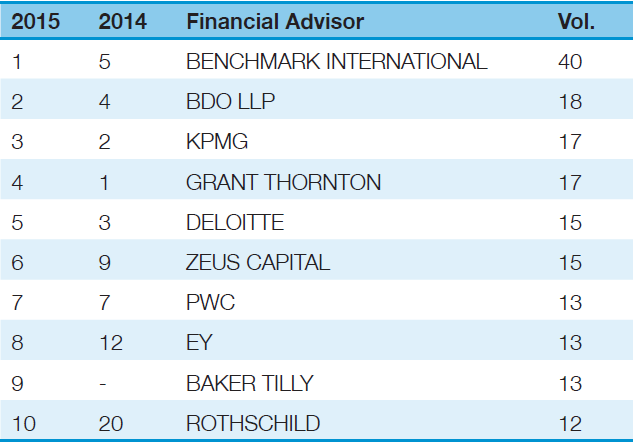

Benchmark International is proud to announce that it has placed top of the North West Financial Adviser table for the second consecutive year in Experian’s annual North West and Manchester Corporate Finance Review.

READ MORE >>Archives

Benchmark International Named as the North West’s No.1 Financial Adviser

Benchmark International Facilitated the Transaction Of Skillets, Inc. To Rosser Capital Partners

Benchmark International has successfully negotiated the sale of Skillets, Inc. (“Skillets”) to Rosser Capital Partners (“RCP”).

Based in Naples, Florida, Skillets has been the staple upscale breakfast and lunch restaurant for both the local community and tourist population since 1995. The company’s owner, Ross Edlund, began his career by owning and operating a successful chain of pastry shops during the 1970’s and 1980’s. Today, Ross can be found at one of the five different Skillets locations, with a sixth to be opened in the Fall of 2016.

For over 20 years, Skillets has been committed to serving only the highest quality ingredients, paired with excellent customer service. With a current presence throughout the Southwest Florida region, Skillets, along with its new partner RCP, remain dedicated to providing an industry-leading level of service and quality while taking the classic breakfast and lunch restaurant to new heights.

Based in Greenwich, Connecticut, RCP is an investment firm with a focus on investing in small to mid-sized restaurant, consumer and retail companies that demonstrate significant potential for growth. Over the last 20-plus years, the principals of Rosser Capital Partners have completed 25 transactions including 18 in the restaurant industry. Some of the firm’s current investments include Barteca Holdings, Hickory Tavern, and PetPeople.

Tyrus O’Neill, Director at Benchmark International, stated, “It was a pleasure to represent Skillets and Ross Edlund in this transaction, and on behalf of Benchmark International, we are extremely pleased with the outcome. Allowing both the seller and acquirer to prosper and benefit is always an ideal end result.”

Senior Associate, Trevor Talkie, added, “Skillets is an excellent addition to the growing portfolio of RCP investments. At the end of the day, we believe our client found the perfect fit to carry on the company’s legacy within the industry. Overall, this has been a thoroughly satisfying experience and we wish both parties the best of luck moving forward.”

Skillets, Inc. President and Founder, Ross Edlund, stated, “Benchmark International’s hands-on approach during all aspects of the transaction process was fundamental in our successful deal closing. Tyrus O’Neill and his team did an outstanding job of putting together a comprehensive, attractive presentation of Skillets, lined us up with first rate legal counsel, and very quickly identified a motivated buyer within two weeks of initial marketing. Overall, RCP is an ideal candidate in terms of corporate culture and values. We appreciate our many loyal Naples guests and look forward to offering the same hospitality and culinary excellence they have come to know as we move forward in this exciting chapter.”

READ MORE >>Share this:

Benchmark International facilitated the transaction of The Common Source to the Aureus Group

Benchmark International facilitated the transaction of The Common Source, located in Houston, Texas. They were acquired by the Aureus Group out of Colorado.

The Common Source, founded by Ann Zdansky in 1997, provides comprehensive information management services to legal firms through their proprietary document review platform. The Aureus Group is a tech focused company.

Benchmark International added value by negotiating, on the seller’s behalf, the most aggressive terms allowing the seller to retain assets that would not be used by the buyer moving forward. Also, negating an equity position for the seller and key employees in the new company was criteria because it allowed all parties to participate in the upside and ensure that they had a say in the company post-closing. This also allowed the seller to remain on board in an advisory role in Aureus. The cultural fit was the number one priority. The Common Source was a very family friendly business and the employees were treated as family by the seller so it was important that a similar culture that would continue post close.

The founder commented, “It was very important that we found someone that would continue the company. Not just come in and say that they were going to buy the company then come in a fire people and sale the equipment…and where just interested in our clients and list of potential clients. It had to be someone that was going to keep as much staff as possible and continue what was started. Benchmark was able to provide the buyer that met [these] needs…and to maintain the level of service for our customers was important as well.”

Senior Associate, Luis Vinals commented, “Benchmark International added value negotiating the asset deal. We saw throughout the deal process that the buyer, Aureus Tech, would acquire all the assets and not continue running a portion of the business that was not related to the existing services. With this knowledge, we were able to negotiate a deal that allowed the seller to retain assets related to a division that the buyer did not current operate or anticipate operating moving forward allowing the seller to obtain the best deal within the open market.”

READ MORE >>Share this:

The Common Source Client Testimonial {video}

Computer RX Client Testimonial {video}

Conarc Client Testimonial {video}

M&A for R+D: what all businesses can learn from consumer goods companies

Recent industry analysis has highlighted a number of complex and significant trends within the consumer goods sector. In a sector powered by names such as Nestlé, Pepsi and Unilever, research shows that R+D budgets are diminishing as a share of revenues, particularly in comparison with highly innovative sectors such as technology. This trend is coupled with the progress made by smaller, newer brands which are eating into the market share in a range of sectors.

READ MORE >>Share this:

Who is Benchmark International? (Video)

Is Verizon set for a data breach discount from Yahoo?

In this digital age, cyber security is a growing global issue, and a costly one at that. No one perhaps knows this better than Yahoo, who this week admitted that it had been victim to a second giant data breach following the recently disclosed 2014 attack that had already damaged the tech giant’s reputation.

READ MORE >>Share this:

The Biggest M&A Deals of 2016

Despite economic and political uncertainty across the globe in 2016, the year remained one of the most active for M&A deals. According to data collected by Dealogic, the value of the average deal in 2016 was $104.2m which, despite being slightly down on 2015’s average of $115.4m, was significantly greater than the average deals made between 2000 and 2014 at $77.1m. Here, we take a look at the biggest transactions that contributed to a successful year of deal making in 2016.

READ MORE >>Share this:

How the Recent Election Result May Impact the Value of Your Company...

Now that we know Donald Trump will lead THE UNITED STATES for the next 4 years, please see how some of his proposed changes may affect the value of your company. VIEW THE DETAILS HERE

There are TWO impending critical issues every business owner should consider when planning an exit or growth strategy.

READ MORE >>Share this:

Benchmark International Facilitates the Transaction between Computer RX and RX30

One of Benchmark International’s Major Transaction Teams, led by Managing Director Kendall Stafford, successfully facilitated the merger of Rx30 and Computer-Rx which closed on October 6, 2016.In June 2015, it was announced that GTCR had made a strategic equity investment in RX30, another deal facilitated by Benchmark International.

Computer-Rx, headquartered in Moore, Oklahoma, is an innovative pharmacy software platform focused on community pharmacies. Rx30, headquartered in Ocoee, Florida, is a leading national developer and supplier of vertical enterprise software that offers pharmacy management software solutions to the independent, hospital, long-term care and specialty pharmacy markets.

Each platform will continue to run independently while leveraging the combined experience and innovations of both companies. The Founder of Computer-Rx, Roger Warkentine, will remain on as an advisor and the current COO, Lauren Warkentine, will become President of Computer-Rx. Steve Wubker, CEO of Rx30, will lead the combined businesses.

Roger Warkentine commented, “The Benchmark team was invaluable throughout the deal. They recommended that we use the same attorneys they previously worked with for Rx30. With Benchmark and the attorneys’ combined knowledge of previous deals and industry standards, we knew that they would be the only representatives that would be able to agree to a great deal on our behalf while keeping our priorities in mind. The combination brings two companies with similar cultures and philosophies together to provide better resources for our clients.”

Benchmark International's Chairman, Steven Keane, commented, “We are delighted with the outcome we were able to achieve for the Warkentine family. They were great to work with and were very deserving of the deal they received. It was a swift deal with obstacles the team had to overcome, but all parties were committed to a successful outcome. ”

READ MORE >>Share this:

Twitter and the great rumour mill of 2016

Author Terry Pratchett once said, “A lie can run round the world before the truth has got its boots on.” Nowhere is this truer than in the world of mergers and acquisitions. The potential buy-out of Twitter by Disney has been the subject of much rumour and this article looks at their veracity as well as examining other suitors that may be eyeing the micro-blogging site.

READ MORE >>Share this:

M&A is Key to Reaching Younger Market

Whether it is a food manufacturer acquiring a start-up that specialises in organic goods or a media company making an investment in app development, there is little doubt that a number of M&A deals are being driven by businesses wanting to make that shift to attracting a younger market.

READ MORE >>Share this:

Germany on track to M&A success

In the first week of September, German companies announced M&A deals amounting to $72bn – a significant contribution to the country’s global share in M&A, which has now doubled.

READ MORE >>Share this:

China Sets Sights on M&A Gold

Chinese Olympians managed to scoop a total of 26 gold medals at the Rio Olympic Games. Although the country’s medal haul was not enough to match its astonishing tally in Beijing in 2008, China finished a commendable third place behind the US and the UK in the medal table.

READ MORE >>Share this:

Benchmark International Advises On the Sale of LTC Services Limited to Russell Taylor Group Limited

Benchmark International is pleased to announce that a deal has been agreed for the sale of LTC Services Limited to Russell Taylor Group.

READ MORE >>Share this:

The Post-Brexit Mega Deals Opening The UK For Business

As the Brexit fallout clears from UK politics a new reality has set in. The new Prime Minister, Theresa May, has made it clear that the UK is still open for business. As if to emphasise that fact, only days after her official appointment, one of the UK’s largest and swiftest deals has been announced, demonstrating how the UK has maintained its attractiveness for investment from overseas companies.

READ MORE >>Share this:

The Biggest M&A Deals of 2016 So Far

How Will the 2016 Budget Affect UK Businesses?

During his Budget speech to Parliament last week, Chancellor of the Exchequer, George Osborne, unveiled a major shake-up of corporate taxes including lowering the main rate companies pay to less than half the rate levied on firms in the United States.

READ MORE >>Share this:

Benchmark International Sponsored Valspar Championship

Benchmark International hosted a string of US clients, retained buyers, former clients, and professional advisers at this year’s PGA Valspar Championship. The Valspar Championship has quickly risen to be a premier PGA tour stop since its inception in 2000 and is set just down the road from Benchmark International’s US headquarters in Tampa, Florida. The firm’s guests enjoyed air conditioned views of the 17th and 18th holes, commonly known as “the Snakepit” and regarded as the last two legs of the “three hardest holes on the PGA Tour.” This included an extremely challenging pin placement for the 17th on Saturday, a mere eight feet away from Benchmark International’s closest seats.

READ MORE >>Share this:

M&A as a Strategy Enabler

Many mistakenly think of an acquisition strategy as the only strategy, leaving the business to ‘float’ while all hands are on deck to steer the company into the hands of another captain. But then what? Rather than be a substitute, M&A should be seen as an enabler putting the wind in the sails of a business.

READ MORE >>Share this:

Benchmark International - The Northern Powerhouse

Benchmark International enjoyed a highly successful year in 2015, completing record numbers of deals across each of its UK and overseas offices.

READ MORE >>Share this:

BENCHMARK INTERNATIONAL REPRESENTED G.W. SCHULTZ TOOL IN RECAPITALIZATION

Benchmark International represented the shareholders of G.W. Schultz Tool (“G.W. Schultz”) in the recently announced recapitalization of the company. Addison Capital Partners, a private equity investment firm partnered with the company in the recapitalization.

READ MORE >>Share this:

Full Steam Ahead for M&A Activity in 2016

According to KPMG’s latest survey of executives, it will be full steam ahead for M&A activity in 2016, so long as businesses get the fundamentals right.

READ MORE >>Share this:

Megadeals to be Replaced by Smaller Deals in 2016

M&A activity in 2015 produced record-breaking results as five of the 20 biggest deals in history were announced. On the heels of this performance, top analysts are looking forward to what 2016 has in store.

READ MORE >>Share this:

Benchmark International Advises on Sale of Swan Seals Limited to Diploma PLC

Benchmark International is pleased to announce the sale of Swan Seals (Aberdeen) Limited (“Swan Seals”) to Diploma PLC. Established in 2003, Aberdeen-based Swan Seals manufactures and supplies seals and sealing products to a wide range of customers who service the North Sea Oil and Gas industry.

READ MORE >>Share this:

BBC Radio 2: Jeremy Vine Talks Family Business

Last week, during Jeremy Vine’s show on BBC 2, the hot topic on the business queries agenda heard Vine and business expert Nick Brown discussing the trials and tribulations that UK family business owners face when they are no longer a part of the company. The key question: do you have an exit strategy in place?

READ MORE >>Share this:

How Family Members Will Deliver Future Business Success

In the latest in our blog series on the impact of family ownership on succession planning for businesses, we look at how complex emotions can result in difficult decision making for businesses owners in terms of exit prospects.

READ MORE >>Share this:

Top Universities Launch Programme to Assist China’s Family Businesses

China is the world’s second-largest economy, second only to the United States, and one where the private sector is dominated by family businesses.

READ MORE >>Share this:

Safety & Technical Hydraulics Limited acquired by ATR Group

Benchmark International has advised on the successful sale of Safety & Technical Hydraulics Limited (Safety & Technical) to ATR Group (ATR) for an undisclosed sum.

READ MORE >>Share this:

UK Budget July 2015: What this means for your business

"The British economy I report on today is fundamentally stronger than it was five years ago. We're growing faster than any other major advanced economy. Our businesses have created two million more jobs" – these were the words from Chancellor of the Exchequer, George Osborne, as he gave the first Conservative Budget since May’s General Election victory.

READ MORE >>Share this:

Mergers & Acquisitions following the General Election

The dust is finally settling on the post-election period. The build up to the election was marked by low levels of activity prompted by uncertainty for investors, so recent ONS statistics delivering the news that Q1 of 2015 had historically low-levels of M&A activity in the UK should come as no surprise. As the Conservative party has secured its first majority for over two decades and is poised to deliver their first budget next month on the 8th July, Benchmark International reviews the press to see what business publications are saying about UK M&A activity in light of the Tory victory.

READ MORE >>Share this:

Kraft Foods set to merge with Heinz

US food consortium Heinz is set to merge with Kraft Foods Group, creating what both companies describe as one of the largest food and beverage company’s in the US, encompassing high profile brands such as Kraft, Heinz and Oscar Mayer.

READ MORE >>Share this:

Intact Pathways acquired by HNWI

Intact Pathways Inc and MyIOM LLC has been acquired by a high net worth individual. Benchmark International has advised the seller on the successful sale of Intact Pathways Inc and MyIOM LLC to a high net worth individual for an undisclosed sum.

READ MORE >>Share this:

Merry Christmas and Happy New Year from Benchmark International

After a long but successful year here at Benchmark International, we’re all looking forward to a hard-earned break over the festive period.

READ MORE >>Share this:

Benchmark International named International Corporate Finance Adviser 2014

Benchmark International is pleased to have been named ‘International Corporate Finance Adviser 2014’ by Corporate Livewire at its ‘Business Awards 2014.’

READ MORE >>Share this:

Autumn Statement 2014 – Highlights

With a general election now in sight, Chancellor George Osbourne delivered his Autumn statement last week to set out the plan he believes will maintain the country’s economic recovery and possibly enhance his party’s chances of retaining power.

READ MORE >>Share this:

Earn-outs: inside and out

Agreements regarding the sale of a business can be structured in many ways, typically involving cash, stock, financing and earn-outs in varying degrees.

READ MORE >>Share this:

Border Group acquired by Premier Forest Group

Benchmark International has advised on the successful sale of Border Group, comprising Border (Disposable) Products Ltd and Lanes Garage (Ystrad Mynack) Ltd (trading as GTP Border Forest and Border Forest Products, respectively) to Premier Forest Group for an undisclosed sum.

READ MORE >> Benchmark International

Benchmark International  Benchmark International

Benchmark International