The merging of two companies can, in any instance, create a significant amount of upheaval, worry or concern for the parties involved. Successfully integrating two organisations without any teething issues is by no means a simple process and, according to professional services giant PWC, the flurry of activity surrounding a deal means that good communication is often overlooked.

READ MORE >>Archives

Communication is Key in M&A

Succession Planning In The Current M&A Market

This article has been produced to give the reader, some insight to developments within the mergers & acquisitions industry, as well as tips when considering funding.

READ MORE >>Share this:

The Impact of the EU Referendum on M&A

The looming EU referendum has undoubtedly created much discussion and debate. While headlines have predominantly focused on two issues. Firstly, whether a Brexit would cause a dip in rates of employment and secondly, the position of influential figures and celebrities in the discussion.

READ MORE >>Share this:

Benchmark International Facilitates the Transaction Between NISSCO and Excell Marketing

Benchmark International has successfully facilitated a common ownership transaction amidst NISSCO Restaurant Dealer Group and Excell Marketing and Procurement Group.

READ MORE >>Share this:

STERLING PROPERTY SERVICES ACQUIRED BY VESTA PROPERTY SERVICES

Benchmark International, acting on behalf of Sterling Property Services, LLC (“Sterling”) and its shareholders of Bonita Springs, Florida, USA, successfully facilitated the sale of Sterling to Vesta Property Services (“Vesta”).

READ MORE >>Share this:

M&A Bridges the Gap Between Millennials and Television

Over the last few years, television has gradually lost its dominance as a source of entertainment, news and information. Viewers, and in particular the millennial generation, are now looking to digital platforms to access their favourite television shows, films, news broadcasts and sports fixtures. With this, television sets are slowly but surely becoming a thing of the past, as viewers increasingly turn to laptops, tablets and other mobile devices.

READ MORE >>Share this:

Kendall Stafford: Winner of 40 Under 40 Award

The M&A Advisor has announced the winners of their 7th Annual Emerging Leaders Awards. Kendall Stafford, Managing Director, located in Benchmark International’s Texas region has been named an Award Winner of this prestigious honor. Kendall was selected as an Emerging Leader in the Dealmaker category amongst other dealmakers from companies such as Raymond James, Deloitte, and PWC.

READ MORE >>Share this:

Recent US Recognition & Awards

Benchmark International continues to rake in awards in 2016. Benchmark International gained recognition in Tampa with the Best of Tampa Award for Business Services and won the 2016 Corporate LiveWire M&A Award Corporate Exit Strategy of the Year for the Fingerprint document while Kendall Stafford, a Managing Director for Benchmark International, won the M&A Advisor Emerging Leaders Award. The company continues to strive for excellence within the industry and 2016 should be no exception.

READ MORE >>Share this:

How Business Owners Can Affect M&A Deals

At first glance, business owners are best-placed to oversee the sale of their company. After all, they are the ones who have been at the helm since the very outset and are likely to have an encyclopedic knowledge of the business’ history, finances, employees past and present and all of the key ingredients that have gone into its success.

READ MORE >>Share this:

M&A Success: When Failure Is Not An Option

We often hear about the significant and market-changing deals that take place, however it is important to remember that there are those that don’t succeed. A study by the Harvard Business Review (HBR) showed that the average rate of M&A failure is at a substantial 80 percent.

READ MORE >>Share this:

M&A Activity on the Menu

When it comes to M&A, the food and beverage sector has seen some interesting activity in the first quarter of 2016. This follows a record breaking 2015 which notably saw H.J. Heinz Company merge with Kraft Foods Group in a deal which is expected to result in the company posting revenues of around $28 billion.

READ MORE >>Share this:

Why Cyber Security is Essential in M&A

As M&A activity increases worldwide, unfortunately so does cyber-crime. Now whilst the two are in no way related, there is no hiding the fact that there has been a number of high profile incidents in recent times, with major companies such as eBay, Target and Yahoo! all being the victims of such crimes.

READ MORE >>Share this:

How M&A Impacts Your Staff

When businesses consider the possibility of a merger or acquisition, the benefits of the change are examined; improved profitability, availability of new markets and enhanced/strengthened competitive position. Now, while it is difficult to argue that these aspects of M&A can be extremely good for a company’s bottom line, the same may not be true for the business’ employees.

READ MORE >>Share this:

Middle Market M&A

While there is much focus on large M&A deals, as well as a vested interest in start-up acquisitions, the middle market can at times be overlooked.

READ MORE >>Share this:

Benchmark International Advises On The Acquisition Of Titan New Lifts Limited By Elevator Engineering Enterprises Limited

Benchmark International is pleased to announce that a deal has been agreed for the sale of Titan New Lifts Ltd to Elevator Engineering Enterprises Ltd.

READ MORE >>Share this:

Good Health for M&A

2015 was recording breaking year for M&A healthcare, with over 1,400 transactions taking place and amounting to roughly £389 billion globally. We take a look at the recent surge in healthcare acquisitions and whether they are set to last.

READ MORE >>Share this:

Benchmark International Advises On The Sale Of UPS Systems PLC & Data Centre Response Limited

Benchmark International is pleased to announce that a deal has been agreed between UPS Systems PLC and Data Centre Response Ltd.

READ MORE >>Share this:

The Benefits of Attending the Accountex National Accountancy Exhibition & Conference

A company's accountant plays a pivotal role in determining both the strengths and aims of their client, as well as being a trusted adviser. Their importance is highlighted when compiling a company’s exit/growth strategy, as they act as a point of contact during any M&A process.

READ MORE >>Share this:

Benchmark International Advises On The Sale Of Spokemead Maintenance Limited To Bilby PLC

Benchmark International is pleased to announce that a deal has been agreed between Spokemead Maintenance Ltd and Bilby PLC.

READ MORE >>Share this:

Benchmark International Advises On The Sale Of Programmable Systems Design Limited To Innovative Control Systems

Benchmark International is pleased to announce that a deal has been agreed between Programmable Systems Design Ltd and Innovative Control Systems.

READ MORE >>Share this:

Benchmark International Advises On The Deal Between Tricorn Systems Limited And Valuechain.Com

Benchmark International is pleased to announce the successful sale of Tricorn Systems Limited to Valuechain.com.

READ MORE >>Share this:

Benchmark International Advises On The Deal Between Ship-Elec And KEW Limited

We at Benchmark International are pleased to announce that a deal has been agreed between Ship-Elec and KEW Ltd.

READ MORE >>Share this:

Benchmark International Advises on the Sale of the Osprey Management Company Limited to K&C Reit Plc

Benchmark International is pleased to announce the sale of the Osprey Management Company Limited to Reit Plc.

READ MORE >>Share this:

How to Navigate M&As as a Small Business or Start-up

As a small business or start-up, the prospect of undergoing a merger or acquisition can be daunting. However, this need not be the case and it can, in fact, bring positive results to your company.

READ MORE >>Share this:

The Rise of Fintech M&A

You may have seen or heard about the latest buzzword for a phenomenon currently causing ripples in the M&A world: Fintech. A contraction of ‘financial technology’, Fintech is shorthand for financially innovative companies, usually start-ups, utilising technology to help make financial services more efficient. It is a growing sector and expected to reach around £5.55 billion by 2018, with firms in Europe experiencing the highest growth. Fintech firms offer a range of financial services including loans, currency exchange and payments, as well as portfolio and wealth management.

READ MORE >>Share this:

Tips for Start-ups: Getting Acquired

Start-ups have increasingly become a sought-after prospect, with major global players such as Apple, Facebook and Google competing to buy their way into new markets and to ensure they have the competitive edge.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Melpass Limited to Vil Holdings Limited

Benchmark International is pleased to have advised on an agreed deal for the sale of Melpass Limited to Vil Holdings Limited.

READ MORE >>Share this:

Component Technology Inc Acquired by Monroe Engineering

Benchmark International has successfully facilitated the transaction between Component Technology, Inc, dba CTI Aviation for 100% sale to Monroe Engineering.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Pocketbond Limited to Bachmann Europe Plc

Benchmark International is pleased to announce the sale of Pocketbond Limited to Bachmann Europe Plc.

READ MORE >>Share this:

Benchmark International Facilitated the Transaction of Conarc, Inc. to Swiftcurrent Holdings, Inc., an Affiliate of ESW Capital, LLC.

Benchmark International has successfully negotiated the sale of Conarc, Inc. (“Conarc”) to Swiftcurrent Holdings, Inc. (“Swiftcurrent”), an affiliate of ESW Capital, LLC ("ESW"). The transaction represents the conjoining of two best-of-breed solution providers.

Based in Alpharetta, Georgia, Conarc develops and sells client management software solutions used in a variety of industries including finance/accounting, real estate, healthcare and insurance. Conarc’s flagship content collaboration software product, iChannel, was built from the ground up by the Conarc development team, allowing the company the flexibility to offer a multifaceted solution with the ability to customize features to client specifications. Additional programs within the Conarc suite of products include a customer relationship management solution, workflow module, a file management system and multiple finance and accounting database products.

For nearly 20 years, Conarc has been committed to finding innovative ways to connect people, businesses, and ideas. With a current presence throughout the United States and Canada, Conarc remains dedicated to continuing improvement and growth.

Based in Austin, Texas, Swiftcurrent is part of the ESW Capital group (www.eswcapital.com) and is specifically focused on acquiring and growing industry-focused business software companies. ESW buys, transforms, and runs mature software and technology companies. By taking advantage of its unique operating platform, ESW revitalizes its acquisitions for sustainable success while making customer satisfaction a top priority. ESW and its affiliated companies have been in the enterprise software space since 1988, and the group includes notable brands such as Trilogy, Aurea, Versata, and Ignite Technologies.

Benchmark International’s Tyrus O’Neill acted as the lead on this transaction and was successful in pinning down the needs of both parties involved, “This is one of those transactions where the parties were truly a good fit right from the start.” O’Neill stated, “On behalf of Benchmark International, we are thrilled to have been able to work alongside our client, Conarc, in this transaction. Chet Joglekarhas built a tremendous suite of software solutions and we believe it is a perfect fit for Swiftcurrent.” Senior Associate, Sunny Garten, added, “We have really enjoyed working with our client, Chet Joglekar, and would like to take this opportunity to wish both parties the best of luck moving forward.”

Conarc, Inc. CEO and Founder, Chet Joglekar, stated, “Benchmark International’s hands-on approach during all aspects of the transaction process was fundamental in our successful deal closing. Benchmark’s industry knowledge and relationships proved to be highly valuable as they assisted us in identifying a buyer that fits our innovative culture and provides Conarc with the resources necessary to continue the company’s trajectory of rapid growth.”

READ MORE >>Share this:

Underground Vision Client Testimonial {video}

The Biggest M&A Deals of 2016 So Far

How Will the 2016 Budget Affect UK Businesses?

During his Budget speech to Parliament last week, Chancellor of the Exchequer, George Osborne, unveiled a major shake-up of corporate taxes including lowering the main rate companies pay to less than half the rate levied on firms in the United States.

READ MORE >>Share this:

BENCHMARK INTERNATIONAL FACILITATES SALE OF ORIGINAL IMPRESSIONS LLC TO POSTAL CENTER INTERNATIONAL, INC.

Benchmark International has successfully negotiated the sale of Original Impressions LLC (“Original Impressions”) to Postal Center International, Inc. (“PCI”).

READ MORE >>Share this:

Benchmark International Advises on the Sale of CH4 Gas Utility & Maintenance Services Limited to Smart Metering Systems Plc

Benchmark International is pleased to announce the sale of CH4 Gas Utility & Maintenance Services Limited to Smart Metering Systems Plc.

READ MORE >>Share this:

The Power of PR in M&A

“People do not buy goods and services. They buy relations, stories and magic.” Seth Godin - American author, entrepreneur and marketer.

READ MORE >>Share this:

RX30 Client Testimonial {video}

Benchmark International Sponsored Valspar Championship

Benchmark International hosted a string of US clients, retained buyers, former clients, and professional advisers at this year’s PGA Valspar Championship. The Valspar Championship has quickly risen to be a premier PGA tour stop since its inception in 2000 and is set just down the road from Benchmark International’s US headquarters in Tampa, Florida. The firm’s guests enjoyed air conditioned views of the 17th and 18th holes, commonly known as “the Snakepit” and regarded as the last two legs of the “three hardest holes on the PGA Tour.” This included an extremely challenging pin placement for the 17th on Saturday, a mere eight feet away from Benchmark International’s closest seats.

READ MORE >>Share this:

M&A as a Strategy Enabler

Many mistakenly think of an acquisition strategy as the only strategy, leaving the business to ‘float’ while all hands are on deck to steer the company into the hands of another captain. But then what? Rather than be a substitute, M&A should be seen as an enabler putting the wind in the sails of a business.

READ MORE >>Share this:

Benchmark International - The Northern Powerhouse

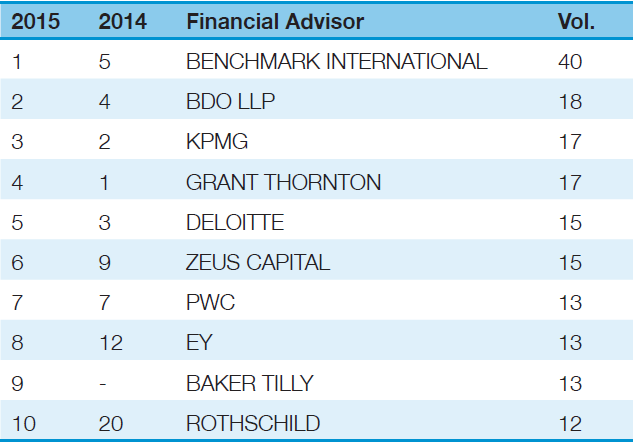

Benchmark International enjoyed a highly successful year in 2015, completing record numbers of deals across each of its UK and overseas offices.

READ MORE >> Benchmark International

Benchmark International  Benchmark International

Benchmark International