Following our report last month on the $130bn mega-merger between US chemical giants Dow Chemical and DuPont, a new deal has announced the creation of a chemicals giant with a market value of approx $14 billion. This latest high-profile transaction across the diversified chemicals sector sees companies are striking ever more aggressive deals to find new ways to slash costs and gain greater scale of their segments, typifying the current market trend for companies to cut costs and boost revenue.

READ MORE >>Archives

Chemicals Sector Continues to Remain Buoyant

Lavazza Weighs M&A Options in a Strengthening Coffee Market

Italy’s largest coffee group by sales, Lavazza now have the capacity to spend up to €2bn on acquisitions to further its global ambitions within a strong industry dominated by Nestlé and JAB of Switzerland.

READ MORE >>Share this:

Apple Gets Into Beddit With Latest Acquisition

Last week it was revealed that Apple had completed a low-key deal to acquire Beddit, a Finnish company that makes sleep-tracking devices compatible with apps for both iOS and the Apple Watch.

READ MORE >>Share this:

Coach Bags Kate Spade

New York design house of modern luxury accessories and lifestyle brands, Coach Inc has acquired its rival Kate Spade & Company for $2.4 billion, a figure “not justified strictly by the numbers” according to the New York Times.

READ MORE >>Share this:

An Apple/Disney Merger on the Cards?

Apple has hit the headlines this week with the media speculating whether or not they are set for a mammoth acquisition due to its significant and ever-growing stash of cash.

READ MORE >>Share this:

SiriusXM Gets Connected With Automatic in $100 Million Deal

This week it was announced SiriusXM would acquire San Francisco-based connected car company Automatic Labs Inc. in a deal worth $100 million, according to TechCrunch.

READ MORE >>Share this:

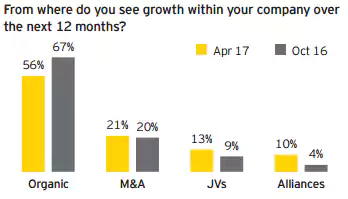

UK Companies Set For A Rampant 12 Months Of M&A Activity

According to a recent report, UK companies are braced for a surge in deal-making this year, as executives prepare their businesses for life away from the European Union.

READ MORE >>Share this:

Exova to be bought by Element Materials in £620m deal

After several weeks of speculation, it has been announced that global lab testing specialist Exova has accepted an all-cash takeover from its industry rival Element Materials Technology Group.

READ MORE >>Share this:

Becton Dickinson acquires C.R. Bard in $24 billion deal

In the biggest deal of the company’s 120-year history, medical device giant Becton, Dickinson & Company has announced its acquisition of C.R. Bard for $24 billion.

READ MORE >>Share this:

Beware of Strangers Bearing Gifts

It appears many buyers are once again attempting to bag bargain acquisitions by exploiting business owners blinded by multi-million pound cheques and disadvantaged by a lack of advice from a seasoned M&A professional.

READ MORE >>Share this:

Best in Show: PetSmart to Acquire Chewy in Record Breaking Deal

This week, PetSmart announced its intention to acquire fast-growing pet food and product site Chewy.com in a deal alleged to fetch $3.35 billion, surpassing Walmart’s $3.3 billion purchase of Jet.com to become the biggest e-commerce deal ever.

READ MORE >>Share this:

Most Important Deal of the Day: Post Holdings Acquires Weetabix

Following months of speculation, it was confirmed last week that US cereal giant Post Holdings is to acquire British cereal company Weetabix in a deal worth £1.4 billion.

READ MORE >>Share this:

M&A Fuels Growth in Gasoline and Industrial Mining Sectors

7-Eleven Inc, the premier name and largest chain in the convenience-retailing industry, recently announced that it has entered into an asset purchase agreement with Sunoco LP. As part of the agreement, 7-Eleven will acquire approximately 1,108 convenience stores located in 18 states.

READ MORE >>Share this:

Chemicals Sector Forges Ahead in M&A Activity

In a move announced on 5th April 2017 and comes hot on the heels of last month’s high profile DowDuPont mega-merger, valued at $130bn, ChemChina has won conditional EU antitrust approval for its $43 billion bid for Syngenta, a Swiss pesticides and seeds group.

READ MORE >>Share this:

Benchmark International Facilitated the Transaction of Label Express Limited to Lynx Equity

Benchmark International is pleased to announce the sale of Label Express Limited to Lynx Equity, a world-renowned manager of private equity funds based in Canada with a diversified portfolio of companies throughout North America.

For the past decade Lynx Equity has focused on 100% acquisitions of old-economy, North American businesses, before entering into the European market at the beginning of 2017. Benchmark International assisted Lynx Equity with the successful acquisition of London-based SignalHome in February, and, with the purchase of Label Express, it is clear that the acquisition trail is proving fruitful.

Established over 30 years ago, Label Express is an industry leading provider of express labelling services, including in-house manufacturing and studio capabilities, to a wide range of underserved niche industries. The company’s strong customer service and sales departments have helped to consistently drive growth over the last seven years, and, today, Label Express is proud to be the label supplier of choice to its many clients.

Roger Forshaw, Associate Director at Benchmark International, who headed up the deal commented, “I am absolutely delighted that we’ve managed to find our clients an acquirer that not only shares the same ethos they instilled over 30 years ago, but also a buyer that will ensure the Label Express name continues long into the foreseeable future. This is made even more satisfying given our clients’ previous attempts to secure a suitable acquirer over the last three years – we are pleased that our efforts made the difference and resulted in a success story for all concerned. I would like to wish my clients all the best with the next chapter of their lives”.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Scan Alarms & Security Systems Limited to Secom PLC

Benchmark International are pleased to announce that a deal has been agreed for the sale of Scan Alarms & Security Systems Limited to Secom PLC.

READ MORE >>Share this:

Benchmark International Advises on the Deal Between Hi-Tech Products Limited to Siegwerk

Benchmark International are pleased to announce that a deal between Hi-Tech Products Limited and Siegwerk has been agreed.

READ MORE >>Share this:

Food sector M&A ripe for the picking

In the biggest deal to date in the natural and organic foods category, and in its largest takeover since 2007, French food company Danone is set to double the size of its US business this month with the acquisition of US organic food producer WhiteWave Foods. This included significant run-rate EBIT synergies of $300 million by 2020, an improvement of Danone’s full year like-for-like sales growth by an extra 0.5 percent to 1 percent, an increase of EBIT margin from 2018 and solid EPS improvement from 2017 and above 10 percent based on run-rate synergies.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Middletons Hotel Limited to Thwaites PLC

Benchmark International is pleased to have advised on an agreed deal for the sale of Middletons Hotel Limited to Thwaites PLC.

READ MORE >>Share this:

M&A: a tool for bringing new teams, skills and talents together?

Market trends mean that deal analysts can typically anticipate which mega-merger is on the cards, or which up-and-coming business is likely to be snapped up by a bigger company. But there are times when M&A announcements come as a real surprise to the industry. Some deals seem so strange that even industry experts expect them to fail.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Vitanium Systems Limited to Lane Telecommunications

Benchmark International is pleased to announce the sale of Vitanium Systems Limited to Lane Telecommunications.

READ MORE >>Share this:

Dow and DuPont get EU go-ahead

The $130bn mega-merger between US chemical giants Dow Chemical and DuPont has been given the go-ahead by the European Commission. Earlier this year, it was announced that the deal would be subject to an investigation from EU competition regulators due to antitrust concerns.

READ MORE >>Share this:

Benchmark International Advises on the Sale of H&G Systems Limited to ATS Global

Benchmark International is pleased to announce the sale of H&G Systems Limited to ATS Global.

READ MORE >>Share this:

Apple acquires award-winning Workflow app

It was announced this week that Apple has purchased DeskConnect, the start-up business behind popular iOS app, Workflow.

READ MORE >>Share this:

Signal is strong for telecoms M&A

Following President Donald Trump’s inauguration in January, he appointed the then-Commissioner of the Federal Communications Commission (FCC) Ajit Pai as the Commission’s Chairman. Pai has served as Commissioner since his appointment by President Obama in 2012, however industry experts predict that Pai’s new role as Chairman spells a positive outlook for M&A in the telecoms sector.

READ MORE >>Share this:

Walmart pushes further into online retail market with new acquisition

It’s no secret that Walmart has grand plans to muscle in on some of Amazon’s online retail market share and it seems the US retail giant has edged closer with the acquisition of ModCloth.

READ MORE >>Share this:

Pinterest Acquires Crowdsourced Q&A Startup

Pinterest, the photo sharing site, has announced this week its acquisition of Jelly, the Q&A app founded by Biz Stone, cofounder of Twitter, in 2013.

READ MORE >>Share this:

EU court annuls block of 2013 UPS and TNT merger

Back in 2013 the EU blocked UPS’s $5.5bn takeover of Dutch-based TNT over concerns that the deal would affect consumers with drastically reduced choice and expected price increases for small parcel delivery in Europe. However, in an interesting turn of events, this week an EU court ruled in agreement with UPS that the EU’s probe, led by the Competition Commissioner at the time Joaquín Almunia, was wrong in its decision to block the deal.

READ MORE >>Share this:

Udacity makes first acquisition with purchase of CloudLab

Online education platform Udacity has completed its first ever acquisition with its purchase of CloudLab for an undisclosed figure. With its specialism in tech-related nanodegrees – vocational qualifications that can be achieved faster and cost less than traditional degrees – Udacity plans to use CloudLab’s platform to allow users to code interactively and collaboratively from within their browsers.

READ MORE >>Share this:

The 2017 Spring Budget

Phillip Hammond of the British Conservative Party has delivered his first budget, outlining the governments plans for both the economy and public finances. We at Benchmark International have put together a summary of all this, highlighting the most important points and explaining just what kind of impact they will have on the average taxpayer.

READ MORE >>Share this:

Fox approaches its first hurdle in its bid to take over Sky

The announcement in December of last year that Rupert Murdoch’s 21st Century Fox was positioned for a full takeover of Sky was hardly one of the most popular deal announcements of 2016, and most certainly the least surprising. The £11.7bn bid has proved to be a contentious one, and Murdoch and co. have now reached one of their first major hurdles in the deal process in the form of competition authorities.

READ MORE >>Share this:

A whopper of an acquisition: Burger King owner purchases Popeyes

The appetite for M&A in the fast food industry shows no sign of waning following news that Popeyes Louisiana Kitchen Inc. has been acquired by the owner of Burger King and Tim Hortons.

READ MORE >>Share this:

Yahoo! and Verizon update: What’s going on?

When it comes to M&A security breaches can be costly in more ways than one. Yahoo!’s expectations of a smooth transition in the Verizon takeover have been scuppered with the news that the acquiring company was not prepared to offer the full asking price.

READ MORE >>Share this:

Benchmark International Advises on the Sale of Jack Lilley Limited to the Lind Group Holding Company Limited

Benchmark International is pleased to announce the sale of Jack Lilley Limited to the Lind Group Holding Company Limited.

READ MORE >>Share this:

Is M&A The Recipe For Bringing The Bite Back To Biscuits?

The UK biscuit industry is crumbling; slowing sales, intense competition and an increase in the price of sugar and wheat have hit the sector hard. Not to mention the pressure from the vast range of new and healthier products that are available. As a result, the UK sweet biscuit market, valued at £1.9bn, is experiencing a flurry of deal making.

READ MORE >>Share this:

Collapsed Cigna and Anthem Merger Goes To Court

Earlier this month, the health insurance organisation Cigna Corp. announced the termination of its $54bn merger agreement with insurance company Anthem Inc. The deal has taken a further complicated turn, after Cigna announced that it had filed a lawsuit against Anthem seeking a $1.85bn termination fee, plus a staggering $13bn in damages. In an interesting twist, Anthem has launched its own lawsuit against Cigna, claiming the company has sabotaged the merger in its attempts to breach the agreement and collapse the $48bn deal.

READ MORE >>Share this:

Benchmark International Named as the North West’s No.1 Financial Adviser

Benchmark International is proud to announce that it has placed top of the North West Financial Adviser table for the second consecutive year in Experian’s annual North West and Manchester Corporate Finance Review.

READ MORE >>Share this:

Dow and DuPont subject to antitrust concerns

The mega-merger between chemicals and seeds producer DuPont and chemical corporation Dow is now expected to close later than anticipated. The $130bn deal has encountered a roadblock as the companies face further regulatory approvals, which means that this is now the second occasion the deal’s completion date has been pushed back.

READ MORE >>Share this:

Tesco and Booker merger reignites Marmite war

They say that you either love it or hate it, but Marmite has been at the centre of a dispute between one of the UK’s largest supermarket chains and the suppliers of the distinctly British condiment. The feud escalated last year after Tesco refused to agree to Unilever’s price increases, however the dispute was resolved in October and Marmite was back on supermarket shelves. But now, the supermarket giant’s £3.9bn takeover of wholesaler Booker is expected to reignite Tesco’s feud with Unilever as critics argue the deal will create an incredibly dominant player in the sector.

READ MORE >>Share this:

Split the bill: Airbnb rumoured to be acquiring Tilt

Ealrier this month, The Information reported that Airbnb is in talks to acquire social payments start-up Tilt, a move that would allow the users of the home share service to split the cost of their trips.

READ MORE >> Benchmark International

Benchmark International  Benchmark International

Benchmark International